Want to know how to get the most from your financial reports? You’re in the right place. Read more to find helpful hints and tips for doing your church or charity accounts.

If you are not already using a charity accounting package, or you are trying to use a business accounting package such as Sage, QuickBooks or Xero to create your charity accounts, then do check out this blog.

Having a good fund accounting package (such as ExpensePlus) will provide you with a streamlined way to manage your church or charity finances, and it will also provide you with all of the financial reports you need.

Funds and financial report

Before looking at key financial reports, let’s first get to grips with the concept of ‘funds’.

A fund is a pot of money, or assets, set aside for a specific purpose. When your charity receives income, you need to allocate this to a fund based on the purpose for which it was given. Similarly, you need to allocate expenditure to a fund. This makes it possible to track how much money given for a specific purpose remains in a fund at any point in time.

Typically, a church or charity will have several different funds which may include the following:

- Unrestricted General Fund – this is usually the ‘main fund’ through which most income and expenditure is recorded.

- Designated Reserves Fund – this holds money set aside as working capital, usually with a balance of either 3 or 6 months working capital.

- Restricted Funds – a separate restricted fund will be created for each grant received (as most grants are given for a specific purpose) and for each fundraising campaign (where you ask donors to give for a specific purpose e.g. towards a building project or to fund a staff role).

A common misconception is that a fund is a bank account – it’s not! Find out more about fund accounting right here.

Income and Expenditure Report

Overview of this financial report

This key report provides a breakdown of income and expenditure. It’s typically the report you will feel most comfortable with. You can usually view it by fund, broken down by category and by month.

Receipts and Payments vs Accruals accounting: If you create accounts on a receipts and payments basis, income and expenditure will appear within this report based on when the money comes in or goes out of your bank account. For example, if you receive Gift Aid income in April, this will appear as April income (even if the Gift Aid claim relates to February). If you create accounts on an accruals basis, income and expenditure will appear based on the date it relates to. For example, Gift Aid for February will appear in February, even if doesn’t arrive into your bank account until April. For more information about accounting basis, click here.

At the bottom of the income and expenditure report there is a summary of income, expenditure, and surplus for each month. Unlike companies, charities are ‘not for profit’, which is why this is ‘surplus’ rather than ‘profit’.

In addition to viewing income and expenditure by fund, your fund accounting software should provide other income and expenditure reports that enable you to view income and expenditure across all funds.

You may also be able to create reports for events that you run (without the need to set up a separate fund for each project/event). For example, in ExpensePlus, the projects report allows you to compare income and expenditure for specific events.

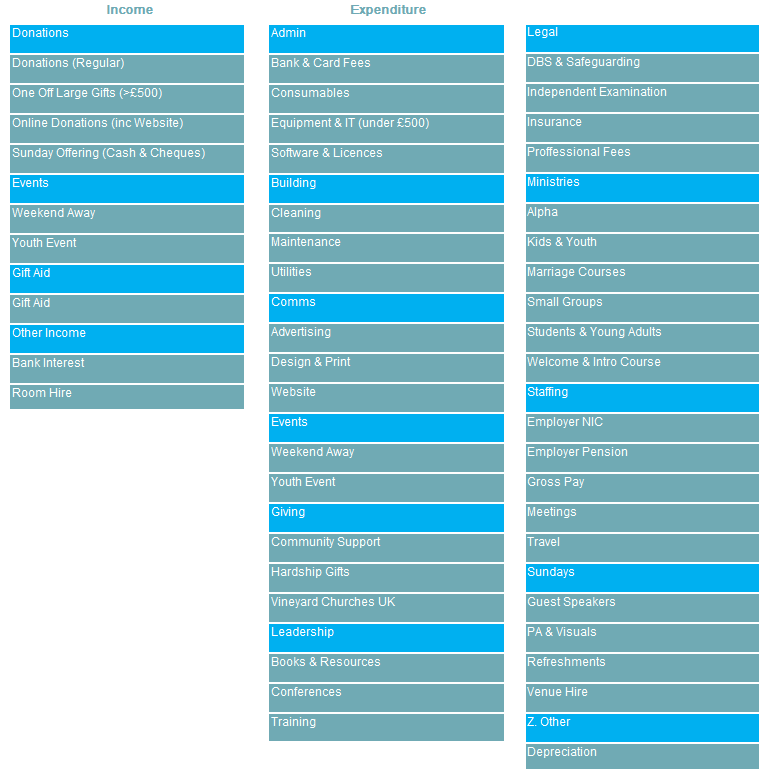

Income and Expenditure Categories

How you structure categories (also known as ‘nominal codes’) determines the breakdown of income and expenditure in the income and expenditure report.

It is up to your church or charity to decide how to structure your categories. Many organisations have less than ideal category structures, typically because:

- They are not aware that it’s possible to change and improve category structure. So instead, they continue with what was done previously.

- The accounting software they use doesn’t allow flexibility to structure or change categories. If this is the case, you should check out ExpensePlus which does allow this flexibility.

- There is an incorrect belief that the category structure must align with the Statement of Financial Activities (SOFA) report structure. The SOFA report is part of a charity’s year-end accounts, but it isn’t ideal for everyday reporting.

- The accounting software doesn’t allow you to set ‘category types’. So, there is no way to structure categories how you wish to and still produce a SOFA report.

Deciding your Category Structure

When deciding your category structure for your organisation, a top tip is to keep it simple! If you are not sure where to start, then we suggest you have:

- 5 to 10 income categories

- 20 to 30 expenditure categories.

Having too many categories can result in the income and expenditure report becoming too long and complicated. Resulting in key people not reading or understanding it.

If you are not sure where to start with your category structure, here are some example categories below for a medium sized church:

Different categories in each fund: most organisations use the same set of categories for each of their funds. But you don’t have to do this. For restricted funds, you may prefer to have a subset of the categories that you have for your general fund. You may wish to have different categories altogether if the general fund categories aren’t suitable.

Budgeting

Once you have your income and expenditure categories, you can create a budget for each category.

Creating a budget has the following advantages:

- you can plan more effectively

- you can compare your actual income and expenditure against your budget

- you can forward project totals to the end of the financial year.

Learn more about creating a budget for your organisation in this Practical Guide for Churches and Charities.

Your budget per category, the % variance between budget and actual income/expenditure, and the projected total will appear in your income and expenditure report. You can find out more about entering your budgets in ExpensePlus here.

What to look for when reviewing the Income & Expenditure Report

Here is a checklist of helpful things to look out for when reviewing this report:

- Transactions recorded against the wrong fund/category that need to be updated

- Income/expenditure recorded against the wrong fund that needs to be updated

- Asset purchases that have not been capitalised (accruals accounting basis only)

- Categories with large variances to budget (to check that transactions are in the correct categories)

- Any missing transactions/adjustments e.g. Gift Aid income

Once you are happy that the report is correct, here are some of the key metrics to review:

- Income for the month (including % variance to budget)

- Expenditure for the month (including % variance to budget)

- Surplus/deficit for previous month (including comparison to budget)

- Income for the financial year to date (including % variance to budget)

- Expenditure for the financial year to date (including % variance to budget)

- Surplus/Deficit for financial year to date

- Projected surplus/deficit at year end

Where there is significant deviation it’s worth trying to understand the detail behind what is happening and consider what changes you need to make.

Fund Movement Summary

Overview of this financial report

The fund movement summary is another really helpful financial report. It shows opening and closing fund balances for each fund. It also summarises the net movement of funds within the financial year. This report is a great way to view fund balances for all funds in one place!

Cash and fund balances: If you create accounts on an accruals basis, then your fund balances are maybe made up of more than just cash. When creating accounts on an accruals basis, fund balances include assets less the liabilities for the fund – see the Balance Sheet section below for more information.

What to look for when reviewing the Fund Movement Summary Report

Here is a checklist of helpful things to look out for when reviewing this report:

- Closing balance for each fund looks correct – review a more detailed breakdown to understand what is happening if you are unsure.

- Closing fund balances aren’t negative – typically fund balances shouldn’t be negative. If they are, you may need to allocate expenditure to another fund.

Use of restricted funds first: where you can pay expenditure from a restricted fund (within the restrictions of what the restricted money was given for) then you should look to do so, rather than paying expenditure from an unrestricted fund.

If you identify any issues when reviewing the fund movement summary report (e.g. expenditure being higher than expected, or income being lower than anticipated), try to understand the detail behind what is happening and consider what changes you need to make.

Balance Sheet Report

Overview of this financial report

If you create accounts on an accruals basis, then the third really important report when managing church or charity accounts is the balance sheet.

The balance sheet report shows a breakdown of all the assets and liabilities of the church or charity either by fund, or for all funds.

You typically view this report at a given point in time. But your accounting software should also enable you to view this report either ‘by month’ and by ‘fund type’.

Your organisation’s assets are more than just the cash in the bank. Assets include:

- Cash (money in the bank and in cash)

- Accounts Receivable (money you are owed e.g. Gift Aid from HMRC)

- Prepayments (money paid in advance e.g. insurance)

- Fixed Assets (any buildings and other capital assets)

- Investment (any investment or shares accounts)

Your organisation also may have liabilities. Liabilities include:

- Accounts Payable (money you owe e.g. PAYE to HMRC)

- Deferred Income (money received in advance e.g. income for a future room hire)

- Loans (any outstanding loans or mortgages)

For receipts and payments accounting: if you create accounts on a receipts and payments basis, the equivalent to the balance sheet report is the ‘statement of assets and liabilities’. The way you account for assets and liabilities on a receipts and payments accounting basis is very different.

What to look for when reviewing the Balance Sheet Report

It’s important to check all of the balances on this report. In particular, you should check that your Accounts Receivable and Accounts Payable balances correctly reflect the money you are owed and owe.

Any Prepayments and Deferred Income balances correctly reflect transactions that relate to a future period.

Auto-accruals: if you create accounts on an accruals basis, then if your fund accounting software has an auto-accruals feature this will save you time, ensure your accounts are accurate, remove the need for manual accruals, and help avoid errors.

As well as checking your balance sheet balances for all funds, it’s also worth checking the balance sheet for each fund separately. This is to avoid the risk that a fund balance is showing as positive (because the total net assets less the liabilities for that fund is positive), but that, for example, the cash balance of the restricted fund is negative.

If you identify any issues when reviewing the balance sheet report (e.g. an accounts receivable balance being higher than anticipated, or your cash balance reducing month on month), try to understand the detail behind what is happening, and consider what changes you need to make.

Accessing Financial Reports

Whilst most organisations do produce financial reports, a common problem is that these are typically PDF or paper-based. This means it’s not possible for others on the team to access up-to-date reports, or to view a breakdown of summary totals within reports.

Not having up-to-date information that is easily available makes it tricky for budget holders to manage their budgets and keep track of the money spent.

A lot of time typically goes into producing financial reports. However, often financial reports are largely historical records of what has happened. Financial reports should instead proactively help inform the team and enable better financial decisions.

If having accurate up-to-date reports that your team can view would be helpful for your church or charity, then you may wish to look at fund accounting packages that can provide you with reports that are cloud-based and easy to access, such as ExpensePlus!

This video shows an overview of the Finance Reports Module in ExpensePlus.

ExpensePlus is a cloud-based fund accounting software package designed for churches and charities. ExpensePlus makes managing fund accounts simple and straightforward. It’s used by hundreds of charities and churches across the UK and is rated 4.8 stars (out of 5) on Google with over 900 user reviews.