In this blog, Andy Bagwell, Executive Director at UK Church Administrators Network (UCAN) and a church consultant, shares his thoughts on the key steps for how to find the right fund accounting software package for your church or charity.

Financial management is a core responsibility for charity trustees and treasurers, which is why finding the right fund accounting software is so important. Whatever the size of your charity, church or non-profit, there is likely to be a system in place. It will be keeping track of income, expenditure, accruals, reporting, fundraising, accounts, and Gift Aid. It may be a simple Excel spreadsheet. Or it could be commercial bookkeeping software installed on a single PC in the corner of the office. It may be a cloud-based accounting system.

If you’re reviewing your setup, there are lots of options to consider. Identifying which accounting software system will best serve your needs can be confusing. Is there a charity-appropriate equivalent to Xero, Quickbooks or Sage? Can I manage Gift Aid in the same package? What about my church parish reporting? Where do I even start in order to find the perfect fund accounting software for my charity or church?

When looking for a fund accounting package you need to start by asking the right questions. Think about what it is you need the software to do.

This article we will cover:

- Two key considerations

- Identifying your key functions

- What makes a good fund accounting package

- Deciding which fund accounting package to use

Two Key Considerations

For charities, churches and non-profit organisations, there are many considerations when it comes to choosing accounting software. Two key considerations should be:

1. Statutory compliance

You need to report on and account for your organisation’s finance in a way that satisfies the annual requirements of The Charity Commission and any other overarching governance conditions.

Statutory compliance is not optional for any organisation, let alone for a charitable organisation which needs to publicly account for the stewardship of its resources in an open and clear way. Good fund accounting for charities and churches is essential. This means maintaining a clear distinction between unrestricted, restricted, and designated funds.

Well-known accounting packages such as Sage, Quickbooks and Xero are perfect for business accounting. But they’re not suitable for creating and managing charity accounts.

2. Efficient day-to-day administration

You need to be able to manage and report finances as part of the day-to-day operations of an organisation. This includes paying bills, meeting staff expenses, claiming Gift Aid, and keeping things running well.

Efficient day-to-day administration is also a hallmark of an effective organisation. Especially charities are often having to find the best way to operate with resource constraints, financial and otherwise.

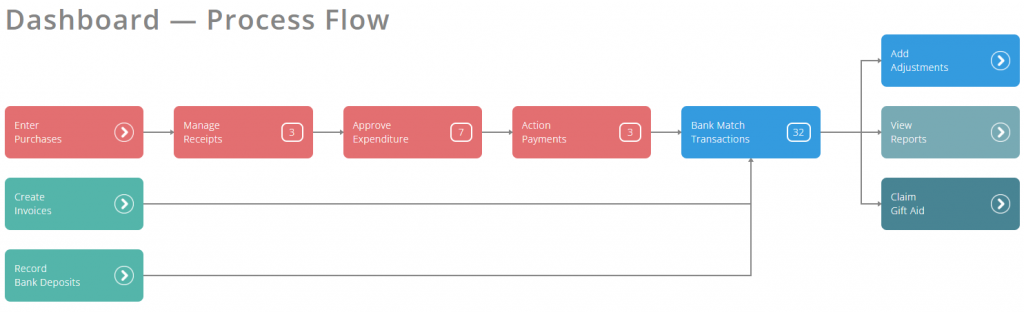

Of the fund accounting packages currently on the market, ExpensePlus is designed specifically with efficiency in mind. It enables churches and charities to simplify and streamline every aspect of the finance process flow.

A less-than-ideal compromise

It can be difficult to bring statutory compliance and efficient administration together. Often the implementation of systems requires a compromise between these two seemingly competing requirements.

You may have heard one of the following sentiments proclaimed by your treasurer or financial administrators:

“We have to do it this way because it helps us with our end-of-year accounts preparation.”

or

“Accounts preparation is always a nightmare as we try and fit the way we do things into a SORP-compliant template”.

However, you need to meet both priorities and do so using a consistent and sustainable method. Often when choosing systems and software, we focus purely on the essential tasks that need to be completed, overlooking the essential functions that need to be fulfilled. This is a common misstep in any type of organisational management.

We can become preoccupied with the many, many tasks that need doing and lose focus on the purpose of why we’re doing them in the first place.

Identify your Key Functions

Leadership expert Patrick Lencioni states that clarity of purpose is essential for an organisation to be healthy and effective. When an organisation is clear about its vision and purpose, its team can gather around that clarity. Then all the functions of the organisation that are overseen by that team can be harnessed towards that purpose. Finance is one of these functions.

What are the essential functions of financial management for charities?

Charitable organisations can exist for many different charitable purposes. For example, to bring social change, reduce poverty, promote religion, provide education, or improve people’s health. You will notice that ‘finance’ is absent from this list. But the old saying that ‘money makes the world go round’ underlines that the proper use of money is necessary for all the purposes listed above. Therefore, finance sits with our charitable sensibilities and beliefs.

There’s no avoiding it. Money will be part of our organisational life and we need to manage it well. To put it another way, money will be required for your organisation to achieve its charitable purposes. As a result, you should aim to manage this money in a way that helps your charity to be effective.

After all, you are trying to get something done – so why not let your financial management be part of this?

Take a few minutes to make a list of all the financial tasks you are regularly involved with. These may include invoice payments, expense claims, payroll, management reports, annual accounts, budget preparation, risk management, Gift Aid claims, donation administration, using petty cash, finance committee meetings, as well as a whole host of others. Now try and sort these into their function. What do I mean by this? Here are some suggestions:

Strategic planning

The need to help the leadership of your organisation plan how to use the financial resources available effectively and prudently, to best meet your organisational goals and purpose.

Effective Governance

To accurately inform those with a governance responsibility (the trustees) as to the financial position, constraints, challenges, and opportunities of the charity. Your board of trustees will hold the ultimate governance responsibility for the management, stewardship, and accountability of your charity’s finance. Some trustee boards focus too much on the compliance requirements for annual reporting. However, The Charity Commission itself expects trustees to help drive forward the organisation strategically. They want trustees to ensure that it allocates resources effectively and provides active scrutiny of leadership proposals.

Empowering your team

Where team members (employed or otherwise) have been given responsibility over specific areas of activity, they will be likely to have a financial element to monitor and manage. A function of good financial management will be to empower these practitioners. This will equip them with the tools they need to monitor their areas of financial responsibility and make well-informed and timely decisions. The more they’re empowered, the greater the potential for accountability.

Efficient administration

Good financial management doesn’t get in the way of the other areas of activity for your organisation. Like the bass line in a well-composed piece of music, it adds the most value when you barely notice it is there, but it is consistently underpinning the whole endeavour. Efficient administration means the timely payment of invoices, a smooth, clear and simple expense process and up-to-date figures and reporting.

Transparent communication

The many stakeholders of your organisation need to be kept ‘in the know’ about the organisation’s finances. These stakeholders may be your trustees, leadership, staff, volunteers, donors or the general public (through charity commission reporting). Within the charitable sector, it is a core responsibility to maintain appropriate transparency about your organisation’s finances.

Stephen Mathews, Head of Consultancy at Stewardship can often be heard quoting that “Charity Finance is a Team Sport”. By this, he means that the effective and healthy management of finances within a charity requires shared and delegated responsibility and needs the involvement of many. It is not an isolated task for the treasurer, bookkeeper, or finance committee. It needs more than rubber-stamping and a cursory glance from your trustees. Active engagement is required by all.

Sadly, many financial systems are designed (intentionally or unintentionally) to centralise knowledge and ‘control’ on a small group of individuals. Other systems run at such a time lag that information is never provided in a timely manner. These systems are of no use to those we’re trying to inform and equip. Any system which creates a personnel or workflow bottleneck will hinder effective functioning. Treasurers and financial administrators have a key role to play in your organisation’s finance. But to do this effectively they need the right tools to equip the team around them.

What makes a good Fund Accounting Software Package?

I’ve worked with many organisations in the charitable sector for over 15 years. Here are my 5 top tips as to what makes good fund accounting software and how to overcome some of the challenges above:

1. Choose software that communicates consistently and purposefully

You manage finance well by communicating well. Your fund accounting system will need to inform others, enabling them to effectively meet their organisational purpose.

- Provide self-service information accessible through a cloud-based fund accounting system. Your leadership, trustees, staff and volunteers should be able to access and help themselves to appropriate information (with appropriate levels of detail) when they need it. A real-time, cloud-based system will enable this and will reduce bottlenecks.

- Use drillable reports. Different reports should be provided with differing levels of detail to different stakeholder groups, but with the ability for further scrutiny when desired.

- Automate communication. Use a system where budget holders are asked to approve expenditure and purchase submitters can check up on the status of their financial transactions without your involvement. This keeps people informed and increases accountability.

2. Choose software that does the work for you (or allows others to)

- Avoid Duplication. Duplicating effort and tasks threatens your ability to be efficient and effective. Therefore, choose a system that remembers how you work, automates functionality, and quick matches recurring transactions at a click of a button. The reconciling of bank statements should prepare your financial reports and gift aid claims for you.

- Allow input from others. Choose software with the ability for your teammates to submit their expense claims directly, allocating the transactions to the appropriate budget codes. This removes you from the workflow and you won’t be a bottleneck.

3. Choose software that is flexible

- Seek out layered and flexible functionality. Use a system which meets your compliance responsibilities and produces your statutory reports whilst servicing your other functionality with no compromise, duplication or additional effort. Successfully handling fund accounting in a SORP-compliant way is a prerequisite but there is no need for this to come at the expense of other functionality. As the great 21st-century philosopher Shrek said, “Onions have layers. Ogres have layers”. Fund accounting software should be the same!

4. Choose software that is intuitive

- Follow a simple and clear workflow. Your financial administration shouldn’t be a mystery. It needs to be clear, to understand how things work, and it should be quick and easy to fulfil what is required. The clearer it is, the more people will get (and stay) in the game. Remember, charity finance is a team sport!

5. Choose software that is built by practitioners

My final top tip is to choose an accounting software package built by experienced experts who understand both your role and the needs of your organisation. Time and time again I have discovered the best systems and software come from practitioners. They have done the job and have the experience, knowledge and passion to develop a system to fulfil the functions, not just to complete the tasks.

Deciding which Fund Accounting Software Package

Effective financial management means you can communicate well within your team and externally, and it needs to be facilitated by good centralised financial software. Ideally, you want software that allows you to accomplish more, in a quicker and more efficient way, with less effort.

Price

Price is often a key consideration when it comes to choosing an accounting package. But it can sometimes be hard to know for sure that the price stated on a company’s website is actually the price you will end up paying 12 months from the start. Here are some helpful things to consider when choosing your fund accounting software:

- Is the price stated as an introductory offer price, and if so, what will the regular monthly price be?

- Is the price stated without VAT (to appear cheaper) and if so, what is the price with VAT?

- Are there any extra charges e.g. for training or setup?

- Is the price fixed, or can the company increase the price when they choose?

- Do you need to sign a contract, and if so, how long for, and what are the terms? (most contracts are for the benefit of the company, rather than the customer!)

- What would happen if you did want to leave – what is the process? will the company export all of your data for you for free?

- Some companies offer a money-back guarantee, which is great in principle, but it’s worth asking to see the small print and process for this upfront and in writing.

Benefit

Firstly, whilst price is important, it probably shouldn’t be the main deciding factor. Choosing the right product has the potential to save you far more than the price of the monthly subscription you will be paying. And if it doesn’t, you probably aren’t getting value for money! For my own church, moving to ExpensePlus enabled us to fully streamline our finance process flow, saving us £6,000 per year on bookkeeping hours. So, even if ExpensePlus cost us £100 per month (which it doesn’t) it would still have been a more cost-effective solution to a package that was, for example, £20 per month.

Secondly, getting a brilliant product with amazing support is far more important than getting something that is cheap. If you decide on the product you buy based on the price, you may come to regret it 12 months down the line. The best (and only) real way to find out what a product is like upfront is to ask someone who already uses it. One easy way to do this is to look at reviews on Google – whilst the star rating is helpful, always read the actual reviews too.

Next steps

I have trialled and used many systems over the years and helped countless churches and charities introduce new fund accounting software, and for me, I’d recommend starting your search by checking out ExpensePlus (as well as other products).

ExpensePlus is an easy-to-use, cloud-based fund accounting package specifically created for not-for-profit organisations. It enables churches and charities to streamline their financial processes and provides a simple and more efficient way to manage expenses, create accounts, view reports, and claim Gift Aid. It’s highly rated by users and comes with brilliant support and training included.