The Charities Statement of Recommended Practice (SORP) outlines the standards, rules, and guidance for churches and charities in the United Kingdom and the Republic of Ireland preparing accounts on an accruals basis. This includes all charitable companies.

Charities with an income of less than £250k* per year are typically able to create accounts on a Receipts and Payments basis (also known as cash accounting), rather than on an accruals basis. Where this is the case, you do not need to follow the Charities SORP and can create simpler Receipts and Payments year-end accounts. *The reporting threshold will be increasing to £500,000 for financial years ending on or after 30th Sept 2026.

What is the Charities SORP?

In this video, Tim Wyatt, from Wyatt & Co Chartered Accountants, explains more about the Charities SORP:

The current version at time of writing is the 2nd edition, effective from January 2019 and published in October 2019. You can access the full document here.

The updated version, the Charities SORP 2026, will apply to accounting periods starting on or after 1 January 2026. You can view an summary of the changes in the updated SORP here.

What is included in the SORP?

The Charities SORP is a substantial document including details on:

- How to structure accounts that meet the requirements of fund accounting

- How to account for different transactions (e.g., understanding the income recognition principles, or when you can class an incoming transaction as negative expenditure)

- Different Balance Sheet items (such as cash, debtors and creditors, fixed assets, etc.)

- How to present year-end financial statements (SOFA, Balance Sheet, Cash Flow Statement*)

- Additional notes and disclosures year-end accounts need to include (e.g. trustee expenses, related party transactions, operating leases)

- What your Trustees Annual Report should cover

*Organisations with an income of less than £500k don’t need to include a Cash Flow Statement

Do I need to read the whole Charities SORP document?

The person preparing your accounts in addition to your Independent Examiner or Auditor should have a sound understanding of the SORP. Generally, it’s not necessary for administrators and bookkeepers to have read the whole document. But you may wish to have it to hand to refer to when needed.

What should we do if our previous year-end accounts haven’t followed the SORP?

Firstly, remember that your accounts only need to follow the SORP if you prepare them on an accruals basis.

Secondly, remember not all areas of the SORP apply to all charities. For example, if your income is below £500k, you don’t need to include a statement of cash flow in your year-end accounts.

If you believe there have been errors or omissions in your previous years’ accounts, contact your Independent Examiner or Auditor. Also, you may need to include extra disclosures and/or restate prior year figures in your next statutory accounts.

Finally, it’s important to have an Independent Examiner who understands fund accounting, which is different to business accounting.

How can ExpensePlus help me comply with the Charities SORP?

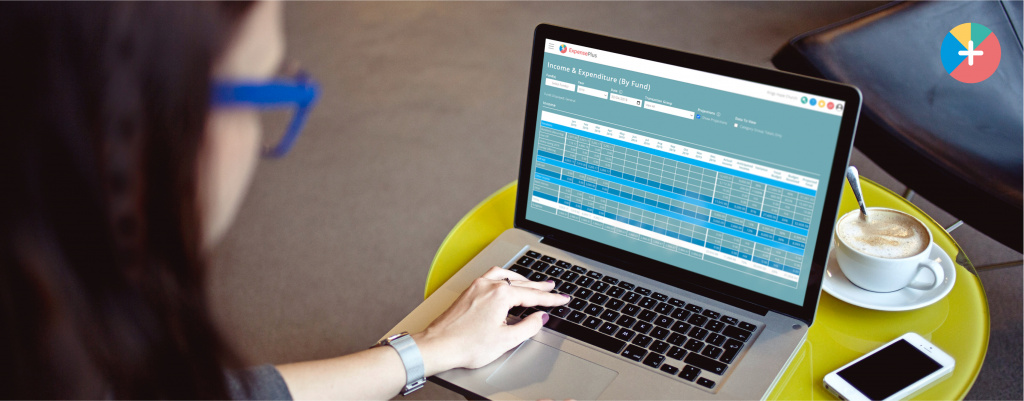

Unlike other accounting packages, ExpensePlus is built with fund accounting at its core.

It keeps your accounting records SORP-compliant and easy to understand and dissect as needed.

For example, amongst the many reports available in ExpensePlus, you’ll find the main financial statements you need to comply with the Charities SORP in the correct formats ready to download to PDF or CSV.

The software has an inbuilt year-end template and checklist that you can complete with guidance for preparing your year-end accounts.

In ExpensePlus, automated warning messages will alert you when you’re about to do something not typically allowed, for example, transfer money out of a restricted fund.

We publish regular blog articles to help you understand fund accounting and offer excellent free training sessions.

Where can I find out more about the Charities SORP?

If you have queries regarding the SORP and its specific application to your organisation and your accounts, you should contact your Independent Examiner or Auditor.

Lastly, the Institute of Chartered Accountants in England and Wales ICAEW have further resources relating to the SORP.

ExpensePlus is a cloud-based fund accounting software package designed for churches and charities. ExpensePlus makes managing fund accounts simple and straightforward. It’s used by hundreds of charities and churches across the UK and is rated 4.8 stars (out of 5) on Google with over 900 user reviews.