The cash flow statement report is a great one-stop shop to see where all your cash has come from, how it’s been spent, and how this relates to the surplus or deficit reported in your accounts.

In this article:

Why do I need a cash flow statement?

In accruals accounting, cash received doesn’t necessarily amount to income. Similarly, cash paid out doesn’t necessarily amount to expenditure.

If your charity’s income is over £500,000, you will need to include a Statement of Cash Flows report in your year end accounts. In this blog, we explain a bit more about this report, and give some examples of how you might want to use it.

You can learn more about creating your year end accounts on an accruals basis here.

Note: Charities with an income of less than £250k per year are typically able to create accounts on a receipts and payments basis (also known as cash accounting), rather than an accruals basis. Where this is the case, you need to submit the simpler Receipts and Payments Statement as part of your year end accounts.

Learn more about receipts and payments accounting and how to create receipts and payments year end accounts.

Note: Charitable companies must prepare accounts on an accruals basis and can’t use receipts and payments accounting.

What does the cash flow statement show?

The Statement of Cash Flows shows how your charity has received and used cash during the reporting period. The report only includes cash based transactions. For example, it takes out any non-cash accounting entries such as depreciation of assets.

The statement is in three sections, showing both cash and non-cash movements. It makes adjustments to reconcile the overall cash movement and surplus/deficit figures. It adjusts for:

- income/expenditure transactions that don’t involve cash – these are included in the surplus (or deficit) figure, but not in cash movements; and

- cash transactions that don’t affect income/expenditure.

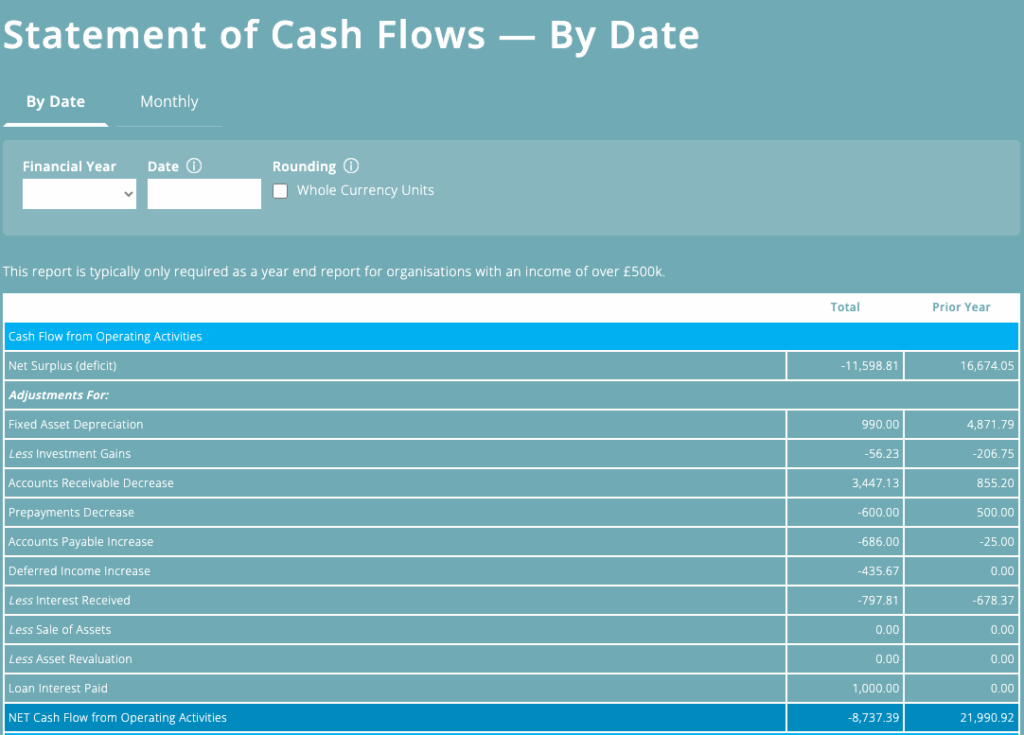

Operating activities

The first section in the cash flow statement is transactions relating to operating activities. The first figure shown is the net surplus (or deficit) from operating activities for the reporting period.

The reporting period is typically, but not necessarily, a financial year. This figure will be close to the surplus/(deficit) reported on the Income and Expenditure (or Profit and Loss) report for the same period, but it will not match it. This is because bank interest received and loan interest paid are not included in operating activities (so not reflected in this figure), whereas these items are included in the income and expenditure surplus (or deficit) for the period.

Other analysis relating to operating activities includes:

- fixed asset depreciation, revaluation, and sales (also known as dispersals)

- investment gains/losses

- increase/decrease in creditors and debtors

- loan interest received and paid.

Investment activities

Analysis of investment activities includes:

- bank interest received

- sales and purchases of fixed assets

- money invested, or returned from investments.

Financing activities

Analysis of financing activities includes:

- loans received and repaid

- loan interest paid.

You can sum up the net cash flow from these three sections to give a figure for the total increase (or decrease) across the reporting period. Some cash flow statements will show how this cash is held across different funds. Remember, these cash balances per fund will not match your fund balances, since the overall fund balances contain other non-cash assets and liabilities. See our Balance Sheet blog for further information.

Here is an example cash flow statement report from ExpensePlus fund accounting software.

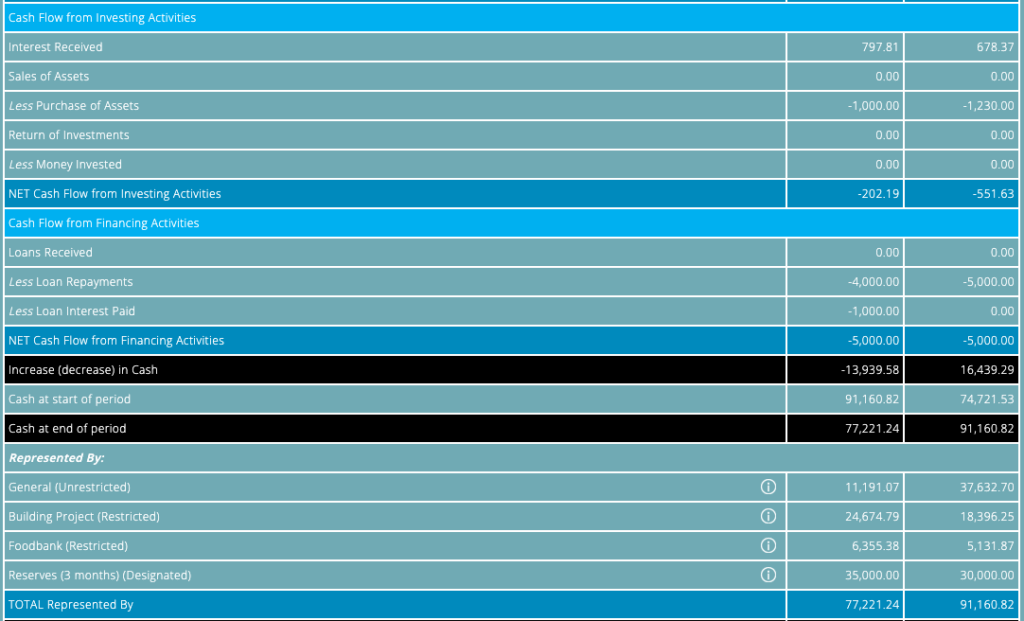

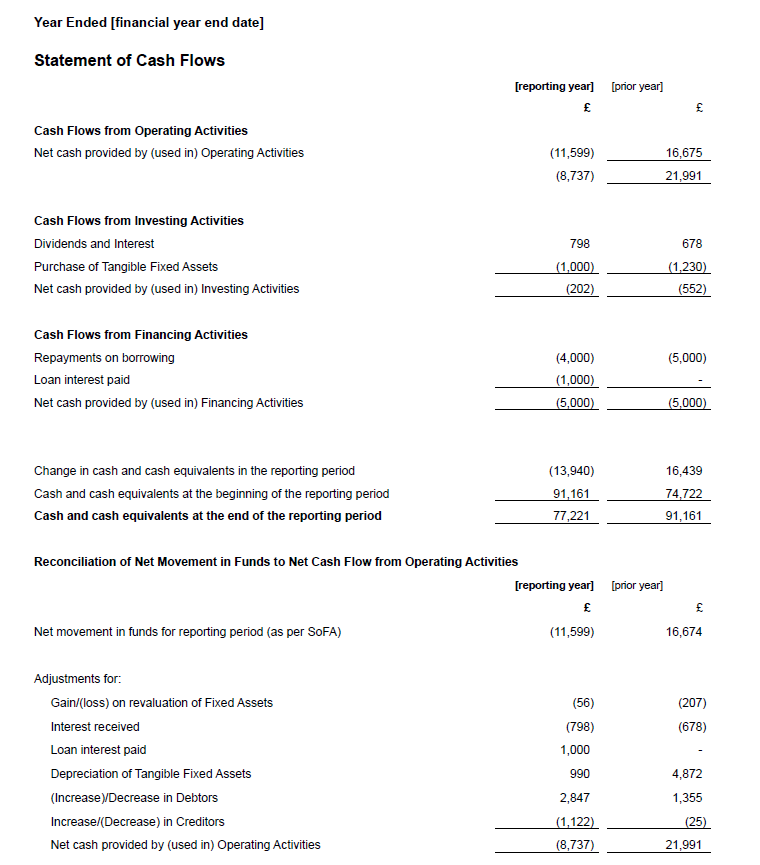

Here is the equivalent report in a format you might recognise from a set of statutory (year end) accounts. Numbers in brackets, for example (11,599), represent negative amounts.

What does the cash flow statement not show?

Internal movements of cash (e.g. bank transfers) are not shown. With these, there is no change to the overall cash position of the charity (and fund cash positions also don’t change as a result of transfers between cash accounts either).

Like other statutory reports, there is no transactional (or even category) detail since it is a summary report. However, in your statutory (year end) accounts, there will be other notes that give further detail on the breakdown of your income and expenditure and cash movements to which the report refers.

A worked example

Consider a very simple accruals-based charity with a starting cash balance of £20,000, and the following transactions:

- donation income of £1,875

- staffing costs of £2,000

- office expenditure of £850

- the purchase of an asset for £4,995

- fixed asset depreciation of £1,200

- the receipt of a loan for £10,000

- loan repayments of £2,000

The table below shows the effect of these transactions on the income/expenditure and cash positions.

Remember that the purchase of an asset, the receipt of a loan, and loan repayments are not income/expenditure in accruals accounting.

This is also true for money invested, or returned from an investment (although these examples are not used as part of this example).

| Transaction | Income/Expenditure | Cash |

| Donation income of £1,875 | +1,875 | +1,875 |

| Staffing costs of £2,000 | -2,000 | -2,000 |

| Office expenditure of £850 | -850 | -850 |

| The purchase of an asset for £4,995 | None | -4,995 |

| Fixed asset depreciation of £1,200 | -1,200 | None |

| The receipt of a loan for £10,000 | None | +10,000 |

| Loan repayments of £2,000 | None | -2,000 |

| TOTAL | -2,175 | +2,030 |

A simplified cash flow statement for this charity would look like this:

Inbuilt cash flow statement in ExpensePlus

ExpensePlus is an easy-to-use, cloud-based fund accounting package that is designed for churches and charities.

The cash flow statement is one of the financial reports included in ExpensePlus.

ExpensePlus can help you:

- create SORP compliant year end accounts, with a year end template to create all the reports you need;

- share information and reports as it is cloud-based, meaning you can see reports and budgets in real-time;

- give user access to the whole team at no extra cost, including your independent examiner, and customise the user permissions, so people only see the information they need.

ExpensePlus is a cloud-based fund accounting software package designed for churches and charities. ExpensePlus makes managing fund accounts simple and straightforward. It’s used by hundreds of charities and churches across the UK and is rated 4.8 stars (out of 5) on Google with over 900 user reviews.