Have you ever wondered what a SOFA report is and how it works? In this blog, we explain the SOFA report and why it’s important for creating year-end accounts on an accruals basis. You’ll also learn what it can tell you about the movement in funds in your church or charity’s finances.

Learn more about creating your year-end accounts on an accruals basis here.

Charities with an income of less than £250k* per year are typically able to create accounts on a Receipts and Payments basis (also known as cash accounting), rather than an accruals basis. Where this is the case, instead of a SOFA report, you need to submit the simpler Receipts and Payments statement as part of your year-end accounts. *The reporting threshold will be increasing to £500,000 for financial years ending on or after 30th Sept 2026.

Note: charitable companies must prepare accounts on an accruals basis and can’t use Receipts and Payments accounting.

What does SOFA stand for?

SOFA stands for Statement Of Financial Activities. Throughout this blog, we’ll refer to this report as the SOFA report.

What does the SOFA report show?

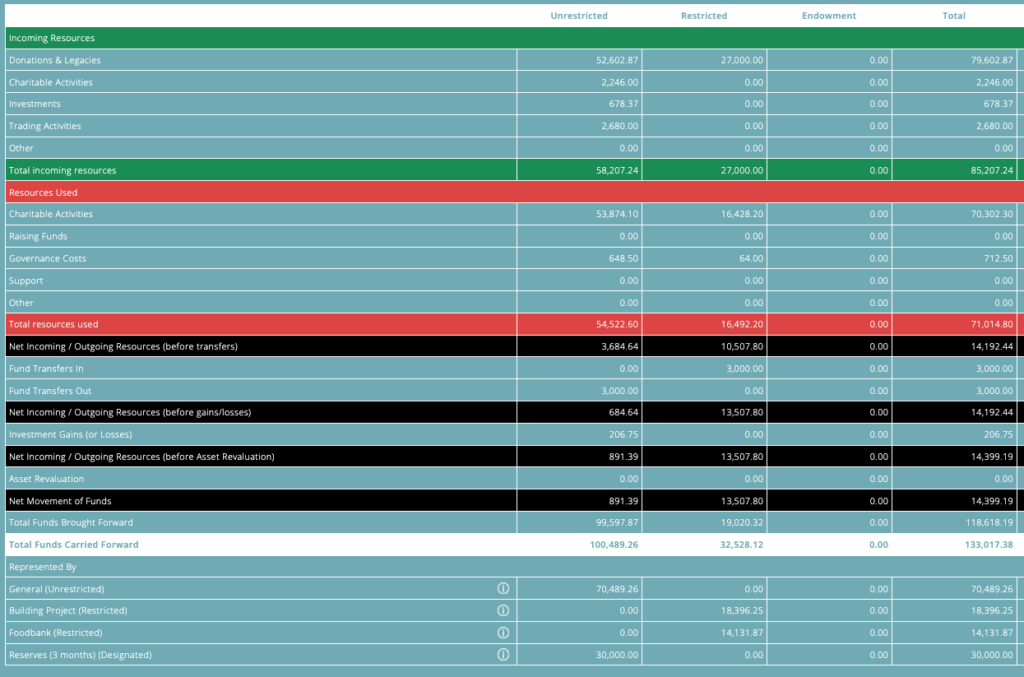

The SOFA report shows the movement in funds over a given period, usually a financial year.

This includes:

- income and expenditure (across different broad classifications, and types of funds);

- transfers between unrestricted and restricted funds;

- gains/losses on investments; and

- revaluation of assets.

The report also shows funds brought forward (at the beginning of the period), and funds carried forward (at the end of the period).

These figures are separated by type of fund:

- unrestricted (including designated);

- restricted; and

- endowment.

Here is an example SOFA report from ExpensePlus (this example organisation doesn’t have any endowment funds).

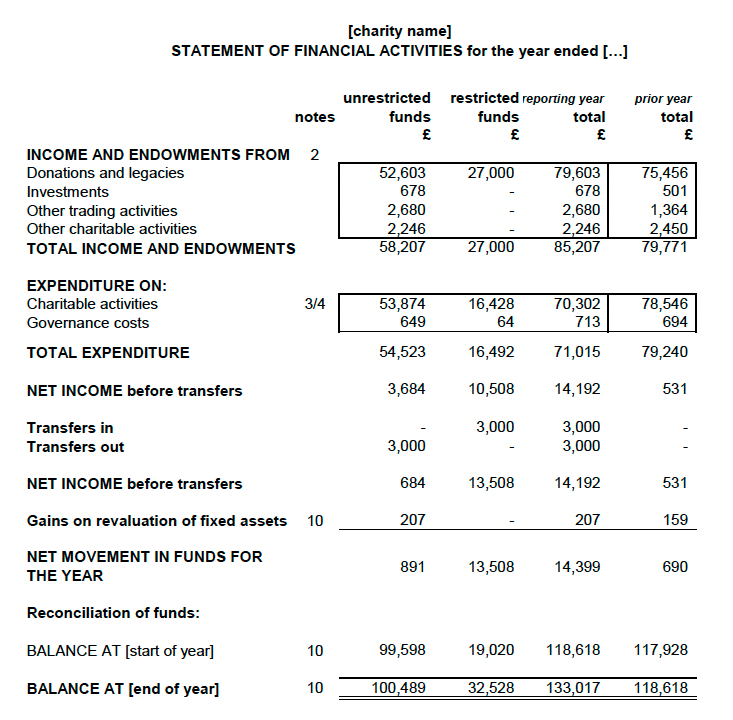

Here is an example of how you might recognise the same report from your statutory (year-end) accounts:

What does the SOFA report not show?

This SOFA report doesn’t show Balance Sheet movements. You can learn more about the Balance Sheet report in this blog.

For example, if you purchase a Fixed Asset this is not classed as expenditure. This simply reduces the cash assets that a fund has and increases the Fixed Asset balance of that fund by the same amount. Therefore, it doesn’t alter the overall fund balance, so doesn’t appear on the SOFA report.

Similarly, if you pay off a loan, this Balance Sheet movement doesn’t affect the fund balance. So, this won’t show up on the SOFA report. It is simply a movement from a cash balance to a creditor balance, inside the same fund.

*so if you choose to capitalise your furniture purchases, your sofa purchase won’t necessarily show on your SOFA report!

Whilst all income and expenditure is represented on the SOFA report, there is not a lot of detail since it is a summary report.

In your statutory (year-end) accounts, there will be other notes which give more detail on both the income and expenditure, broken down by classifications. In ExpensePlus accounting software these are referred to as category types.

You may also want to provide more detail, in a different form, to create your internal management accounts/trustee reports. There is no problem with doing this. Indeed, it’s typical for organisations to report internally under a different category structure to that presented to the public and Charity Commission at year-end. The best accounting packages allow you to use different category structures (or classifications) for internal reporting and statutory reporting.

How is the SOFA different from the Fund Movement Summary report?

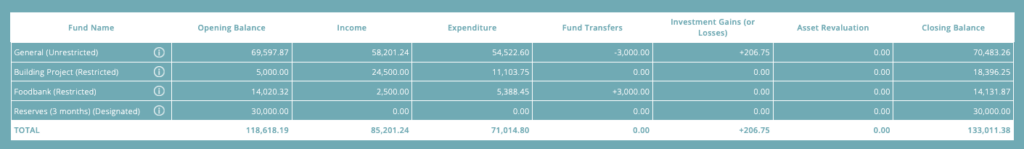

There are many similarities between the SOFA report and Fund Movement Summary report.

Both show the movement in funds (including income and expenditure) across your whole organisation’s finances.

Whilst you will include a note in your accounts regarding the movement in funds, the Fund Movement Summary is more of a management report. It gives detail about the funds in which income and expenditure took place. This is useful for finance teams and trustees to have a headline overview of their organisation’s finances all on one screen.

Here is an example Fund Movement Summary report from ExpensePlus:

By contrast, the SOFA report gives more detail on the types of income and expenditure. For example, Donations and Legacies income, Trading income, Charitable Activities expenditure, Governance costs, etc.

Why is the SOFA report important?

The SOFA report is one of the three main financial statements, along with:

- the Statement of Financial Position (otherwise known as the Balance Sheet); and

- the Statement of Cash Flows (which you only need to include in your statutory accounts if your income is above £500k in England and Wales).

The SOFA is the only statutory report that shows an organisation’s income and expenditure all in one place. It is the first headline report in a set of statutory accounts. Funders, supporters, examiners, and others can tell a lot from looking at a one-page SOFA report.

For example, as well as the headline income and expenditure items, the split between unrestricted and restricted activity shows how a charity’s unrestricted reserves are subsidising projects with restricted funding.

How does the SOFA report work in ExpensePlus?

There are two types of the SOFA report in ExpensePlus:

- a simple report, which is in the format you’ll need for your statutory year-end accounts; and

- a detailed report, which breaks your income and expenditure into category types.

Knowing the details is useful for your income and expenditure notes which follow the main financial statements (SOFA, Balance Sheet, and Cash Flow Statement) in your accounts.

As with many reports in ExpensePlus, the reports are drillable. This means that, with the right permissions, you can click into the figures on the report. You’ll be taken to a more detailed report which shows the transactions which make up these figures. You can also download reports to PDF or CSV formats.

Which SOFA headings should I use?

The broad classifications used in the SOFA can’t be changed as they are defined by the Charities SORP. This stands for ‘Statement of Recommended Practice’.

However, you can create your own headings under each SOFA classification.

In ExpensePlus, the headings you add to form the detailed SOFA report (or detailed Receipts & Payments report) are called category types. Each category in ExpensePlus will need to be linked to a category type. Then, all income or expenditure coded to this category will be included against the linked category type in the SOFA (or Receipts & Payments) reports.

Whichever accounting package you use, here are some common uses of the broad SOFA classifications.

Income

- Donations & Legacies – commonly, you’ll want to use this for all income categories relating to donations, legacies, grants, and gift aid

- Charitable Activities – commonly, this is used for all other non-donation income categories, such as event income, hire of non-investment properties (e.g. church hall hire) etc.

- Investments – commonly, this is only used for the category relating to bank interest received, investment dividend income, and rental income from investment properties

- Trading Activities – Most charitable organisations do not use this category type unless the charity has a trading arm outside its charitable objectives, e.g. a conference centre or café (contact your Independent Examiner or Auditor if unsure about this).

Expenditure

- Charitable Activities – this is usually used for the majority of charitable expenditure

- Raising Funds – this is commonly used for the direct costs of fundraising, e.g. salaries and employment costs of fundraising employees, fundraising regulatory costs, event costs directly attributable to fundraising events, running costs of donation machines etc

- Governance costs – this is usually used for the costs of supporting the organisation’s governance including your Independent Examination/Audit fee

- Support – this is commonly used for central costs such as administration.

Further Resources

If you want to find out more about Fund Accounting, either:

- check out our other fund accounting blogs, or

- visit the Stewardship Resources Hub which has lots of helpful information and resources.

ExpensePlus is a cloud-based fund accounting software package designed for churches and charities. ExpensePlus makes managing fund accounts simple and straightforward. It’s used by hundreds of charities and churches across the UK and is rated 4.8 stars (out of 5) on Google with over 900 user reviews.