Have you ever wondered what a balance sheet is and how it works? Perhaps you are looking at the balance sheet for your charity, and you are not sure what it is showing, or what questions to ask. In this blog, we’ll explore the balance sheet report and how you can use it in charity accounting.

What is a Balance Sheet?

In accruals accounting, there are 3 key financial statements:

- the Balance Sheet

- the Statement of Financial Activities (also called SOFA report), and

- the Cash Flow Statement (which you only need to include in your statutory accounts if your income is above £500k in England and Wales).

Learn more about creating your year-end accounts on an accruals basis here.

Note: charities with an income of less than £250k* per year are typically able to create accounts on a Receipts and Payments basis (also known as cash accounting), rather than an accruals basis. Where this is the case, instead of a Balance Sheet report, you need to submit the simpler Assets and Liabilities Statement. *The reporting threshold will be increasing to £500,000 for financial years ending on or after 30th Sept 2026.

Note: charitable companies must prepare accounts on an accruals basis and can’t use Receipts and Payments accounting.

We call the Balance Sheet report a balance sheet because it has two halves that must balance.

The first part of the report shows both:

- Assets – what the charity owns or is due in, including cash, investments, fixed assets, accounts receivable, and prepayments

- Liabilities – what the charity owes or is due out, including accounts payable, deferred income, and loans

The ‘Net Assets’ of a charity is the difference between the total assets minus the total liabilities.

The second part of the report shows a breakdown of the charity’s funds. Typically, most charities will have several different funds, which will be either unrestricted or restricted.

In fund accounting, funds are not bank accounts. Find out more about fund accounting and funds here.

What are Assets?

Assets are everything the charity owns that helps it to operate. This includes property, money, land, vehicles and equipment.

Assets are typically classified as either:

- Current Assets – Assets that are either cash, or that we expect to convert into cash (generally within 12 months)

- Non-current Assets – All other assets that aren’t current assets (such as fixed assets)

Current Assets can include:

- Cash – This is the most liquid asset of a charity. It is important in enabling the charity to pay expenses and invoices. The term cash typically includes money in the bank as well as physical cash. A charity needs to hold reserves of cash for a number of reasons (see ‘reserves’ below).

- Accounts Receivable – Money owed to the charity. You may also know them as ‘trade debtors’. For example, Gift Aid due in from HMRC that relates to one accounting period, but that you don’t receive from HMRC until the next accounting period.

- Prepayments – Money paid in advance, which relates to a later accounting period. For example, payments of deposits, prepaid expenses, or insurance costs paid in the current accounting period, but all, or part of which, relate to the next accounting period.

Non-current Assets can include:

- Fixed Assets – For example, a long-term tangible piece of property or equipment that a charity owns and uses in its operations, such as IT equipment, vehicles, land or buildings. Fixed assets form part of what a charity owns. A charity’s balance sheet includes fixed assets.

- Investments – A charity holds investments with the intention of providing a financial return. It can use the return to help deliver its charitable purposes. For example, the charity may own a building, which it rents out, and therefore receives rental income. Or it may own a portfolio of stocks and shares.

What are Liabilities?

Liabilities are debts which the charity owes. These can include mortgages and loans, credit card balances, and other money owed (accounts payable). Also, liabilities include money received in advance (deferred income).

Liabilities are typically classified as either:

- Current Liabilities – A current liability is a debt which the charity expects to settle (generally within 12 months).

- Non-current Liabilities – All other liabilities that aren’t current liabilities (such as long-term loans)

Current liabilities can include:

- Accounts Payable – Money which the charity owes, that it needs to pay to suppliers, individuals or other organisations for goods or services. You may also know this as ‘trade creditors’ or ‘trade payables’. For example, PAYE owed to HMRC that relates to one accounting period but that isn’t paid to HMRC until the next accounting period.

- Deferred Income – Money received in advance, which relates to a later account period. For example, ticket income received now for an event your charity is organising, which will take place in the next accounting period.

Non-current liabilities can include:

- Loans – A debt incurred by the charity when a lender (such as a mortgage provider) lends money to the charity. When a charity borrows money the ‘cash’ line in the assets section of the charity’s balance sheet increases by the amount borrowed. At the same time, the ‘loan’ line in the liabilities section of the balance sheet also increases by the same amount. Thus, the overall net assets of the charity remain unchanged.

Learn more about fund accounting terminology here.

For a more detailed explanation of creditors and debtors, check out this blog.

What does the Balance Sheet show?

The Income and Expenditure, or Cash Flow, reports show activity over a given period of time.

In contrast, the Balance Sheet shows an organisation’s financial position at a particular point in time. This is typically the end of the financial period.

Within year-end accounts, the Balance Sheet shows the position of a charity’s assets, liabilities and fund balances on the last day of the financial year.

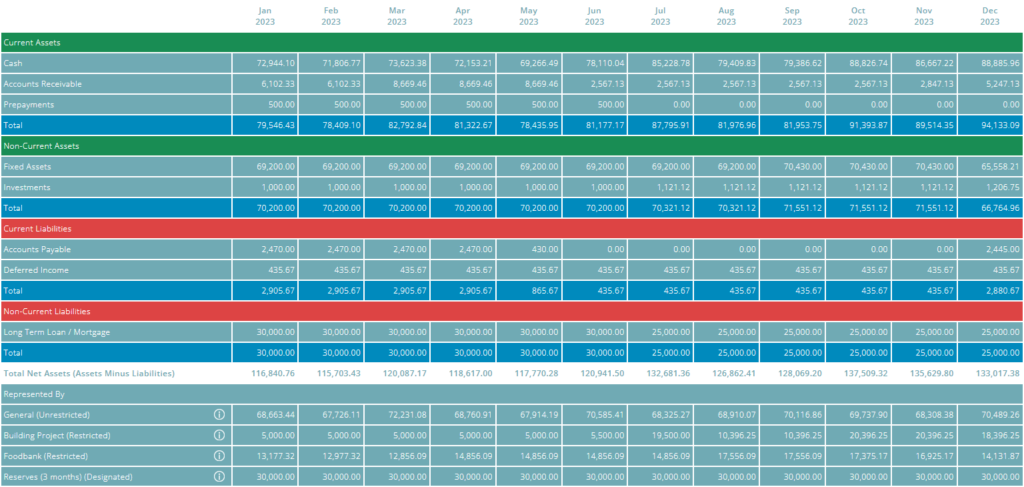

Some accounting packages, like ExpensePlus, enable you to view these balances across the financial year. This can be useful, particularly if month on month any of the asset or liability balances are increasing or decreasing over time.

In terms of year-end accounting, the report shows balances by fund type.

This is why having a fund accounting software like ExpensePlus, that is specifically designed for charities, is so important.

In contrast, packages like Sage, Xero or QuickBooks, are designed for businesses. They don’t offer the fund accounting reports you need to create your accounts. They also won’t have the features you need, such as donor and Gift Aid management.

Here is an example Balance Sheet from ExpensePlus showing assets, liabilities, and the fund balances that represent the net assets. Below is also an example of how this might look in your statutory (year-end) accounts:

Why is a Balance Sheet important?

In accruals accounting, your fund balances are more than cash balances.

It is really important that you understand what makes up your fund balances:

- for understanding the health of your charity’s finances and;

- for managing cash flow.

Example scenarios

Here are a few example scenarios of where looking at the balance sheet can help you understand your charity accounts better:

Your charity might have a bank balance of £100k and someone suggests purchasing a new AV system for £25k. On the face of it, you have sufficient money to cover this cost. However, perhaps £60k of the money in your bank is grants, which your charity received for specific projects. These funds are therefore restricted. £20k is reserves set aside by your trustees (designated). Therefore, only £20k is unrestricted money. Knowing this, the answer to whether you can afford the AV system is actually no!

If your charity has £30k in the bank, but you’ve got £10k of accounts payable showing on your balance sheet. Again, this is important to understand. As soon as the £10k that your charity owes is paid, then in terms of cash flow, your bank balance is going to drop by £10k.

Your charity is short on cash. But your balance sheet shows that you have accounts receivable of £10k relating to customer invoices you issue, but that have not yet been paid. You can chase the payment for these. You can also consider shortening your payment terms to reduce your accounts receivable balance and increase your cash balance.

You’ve seen that the balance of one of your funds is £1m, and you are thinking ‘wow’. But when looking at the balance sheet for that fund, you see that the fund balance is made up solely of fixed assets – these relate to the main building your charity owns. Therefore, you have a high net asset balance, but you may still have cash flow issues. To release cash from the asset of the building, you would need to sell the building, or release capital from the building by taking out a mortgage on it.

Using your balance sheet

In accruals accounting, income and expenditure is accounted for in the period it relates to, rather than on the date it comes into or goes out of the charity bank account.

This means that your income and expenditure reports and your fund balances show an accurate picture of what has been received in and spent out, and what net assets your charity holds.

The balance sheet is important because it shows a breakdown of the assets and liabilities that make up your fund balance totals.

Therefore, it’s really important for charity finance teams to have an understanding of the balance sheet report in order to make informed decisions.

Further Resources

If you want to find out more about Fund Accounting, check out our other fund accounting blogs, or visit the Stewardship Resources Hub, which has lots of helpful information and resources.

ExpensePlus is a cloud-based fund accounting software package designed for churches and charities. ExpensePlus makes managing fund accounts simple and straightforward. It’s used by hundreds of charities and churches across the UK and is rated 4.8 stars (out of 5) on Google with over 900 user reviews.