Charities with an annual income over £250,000, or which are charitable companies, need to prepare accruals based year end accounts.

Whether you use accounting software or a spreadsheet to manage your finances, this blog provides a step-by-step guide for creating year end accounts on an accruals basis.

Table of contents

How long do charities have to file accounts?

You have up to 10 months after the end of your financial year to file accounts with the Charity

Commission.

For charities that are charitable companies, you will also need to file accounts with Companies House. The deadline for this is 9 months after the end of your financial year.

In this time you will need to:

- Prepare your accounts

- Allow time to write the Trustees’ Report

- Have your Independent Examiner review your accounts

- Allow time for sign-off and submission of your accounts

So, it’s best not to leave creating your year end accounts until the last minute!

If your charity’s accounts are filed late, this will show on the Charity Commission website. It’s likely to put off potential grant funders and raise governance questions for anyone viewing your accounts.

What are accruals based accounts

In accruals based accounting, charities must prepare accounts that comply with the Charities SORP. This stands for ‘Statement of Recommended Practice’.

When creating accruals based accounts, costs or income of a particular activity are allocated according to when you incurred the liability, or when there is entitlement or certainty about income. This is not necessarily the date on which you received or paid out the money.

Example: Gift Aid income received from HMRC is accounted for based on the financial year it relates to (not based on the date it arrives in the bank account).

See these blog posts to find out more about:

It’s typically worth waiting for a short period (3 to 4 weeks) before starting the process of creating year end accounts. This allows for income and expenditure that relates to the prior financial year that is recorded after your year end, and which needs to be accrued for in the accounts you create.

15 key year end checks for accruals accounts

Before creating year end accounts, you need to ensure that the financial year you are creating accounts for is complete. You should check that all of the information is correct.

To help you do this, use this checklist of the key tasks. Once these checks are complete, creating year end accounts is quick and easy.

1. Opening Fund Balances

Closing fund balances from the prior financial year carry forward to become the opening fund balances for the next financial year. It is therefore important to check that your opening fund balances in your accounting software or spreadsheet match the fund balances stated in your prior year accounts submitted to the Charity Commission. If they don’t, the accounts you are creating will be incorrect.

If you are trying to use a business accounting package like Sage, QuickBooks or Xero to create charity accounts, it’s worth keeping in mind these packages aren’t designed for charities. These packages don’t have the concept of funds. Additionally, you won’t be able to generate SORP compliant reports needed for your year end accounts.

You can download a copy of your submitted accounts for your prior year from the Charity Commission website. Just search your charity name or charity number and select the charity. Then select the ‘Accounts and annual returns’ option on the sidebar menu.

2. Bank Transactions

It’s important to ensure all bank transactions have been included and reconciled. If you use a fund accounting package like ExpensePlus with automated bank feeds, or if you download bank transactions as a .CSV file and upload these to your accounting software, then you are less likely to go wrong. If you manually key in bank transactions, there is a greater risk that there will be missing or incorrectly entered bank transactions.

Either way, at year end you need to check that bank transactions are not missing from the accounts you are creating. An easy way to check this is to compare the balances on your actual bank statements against the balances at year end, according to the accounting software or spreadsheet.

If there is a mismatch, you will need to investigate further to find which bank transactions are missing or duplicated and fix any issues.

You also need to check that all bank transactions have been reconciled correctly.

Your Independent Examiner should request to see all bank statements for the financial year in question. So, it’s worth downloading these from your online banking in .PDF form, ready to send to your examiner.

3. Petty Cash Accounts

If you have petty cash accounts, then you need to ensure that all petty cash transactions have been recorded.

You need to record all income and all expenditure (not just net amounts).

A good fund accounting package should have an inbuilt petty cash feature. This will allow those managing petty cash to record petty cash income and expenditure during the financial year. If you keep petty cash records on paper, you will need to key in your petty cash transactions.

Once all of your petty cash transactions have been entered into your fund accounting software or spreadsheet, you should check that the petty cash balances at the end of the financial year match the actual physical cash you hold.

If there is a mismatch you will need to investigate further. Where transactions haven’t been recorded, you will need to add them. Where required, you may need to add a miscellaneous income / expenditure transaction to correct the difference.

Accurate recording of petty cash is often problematic. If this is the case for your church or charity, you may wish to consider alternatives to petty cash. For example, having software to manage expenses digitally means staff and volunteers can submit expense claims easily online. They can also get paid back quickly, removing the need for petty cash payments.

4. Purchase Receipts

Where purchases have been made, retaining receipts and invoices is a key part of keeping proper financial records. Your Independent Examiner should check receipts as part of their examination of your accounts.

If you are using a fund accounting package like ExpensePlus, then receipts are digital. They can either be uploaded, photographed or emailed as part of a streamlined digital process flow. Staff and volunteers use this process flow to claim expenses, record invoices, and submit business card purchases.

Not only does this save time, paper and money, but it also removes the need to file paper records. At year end, you can simply give your Independent Examiner access to your cloud-based ExpensePlus account to view receipts digitally.

There is no requirement to keep physical receipts and invoices if they are stored digitally.

If you are keeping paper-based receipts, speak to your Independent Examiner about how they will review receipts. For example, they may request a sample of receipts to be sent to them.

Your Independent Examiner will likely want to understand the controls you have in place for purchase approvals and payments. They will also check that proper records are being kept and monitor how many receipts have been lost. Using a fund accounting package with an inbuilt expenses and payments process flow with digital receipts helps with this. It also provides visibility of purchases without receipts.

5. Income Documentation

As well as keeping documentation for purchases, you also need to keep invoices you have created and sent to customers.

Whilst most donations and other income won’t require documentation, you will need to keep documentation for any grants, legacies and large donations you receive. Again, your Independent Examiner should ask to see these to check for any restrictions attached to this income, and to ensure it has been correctly accounted for. For example, they will check if a restricted fund was created to allocate restricted grant income. Find out more about fund accounting and the purpose of funds.

With a fund accounting package, you can easily view which income transactions require documentation and attach documents digitally to those transactions.

In addition to income documentation, your Independent Examiner may also wish to review records of bank deposits. If you use a fund accounting package like ExpensePlus they can access these as a digital record.

6. Recording of Transactions

It’s important to ensure that all transactions have been recorded correctly before you create your year end accounts. If, like most churches and charities, you check your financial reports each month as you create internal finance reports, then this step probably won’t take too long.

How you perform this check will depend on which fund accounting package or spreadsheet you use. The disadvantage of a spreadsheet is that it is prone to produce errors.

You may wish to review how each bank transaction has been reconciled and/or view income and expenditure reports to identify anything unexpected that needs further investigation.

If you have a fund accounting package like ExpensePlus, then these checks are easy to do. You can drill into reports and view transactions and receipts at the click of a button.

A fund isn’t the same as a bank account. Therefore, the fund a transaction is recorded to is not based on the bank account it was paid from or into. Find out more about fund accounting.

You may wish to check that all transactions are recorded to the correct category within a fund. However, it’s far more important to focus on transactions that may have been recorded to the wrong fund.

Three things you should particularly look out for are:

- Restricted Income that has been incorrectly recorded to an unrestricted fund – A question to ask yourself when deciding whether income is restricted or not is, “Can we spend this money on anything we choose?” (as long as it is within our overall charitable objectives). If the answer is “no” (e.g. because the donor/grant funder said they wanted it to be used for a given purpose), then the income should be accounted for as restricted income (and not allocated to your general fund).

- Expenditure within each restricted fund is not appropriate for the restrictions of that fund – For example, if you received income to run a foodbank, you can’t be allocating expenditure that is outside of what the donation or grant was given for (unless you get written permission from all donors/grant funders to do so).

- Expenditure recorded to the general fund that can be allocated to one of your restricted funds – You want to be ‘using up’ your restricted funds first (where it falls within the restrictions of the money given). Therefore, you should only allocate expenditure to your general fund if there isn’t an appropriate restricted fund that can cover the expenditure.

If your charity has multiple bank accounts, transfers between bank accounts need to be recorded as bank-to-bank transfers. They should not be recorded as expenditure from one bank account and income into the other bank account. This would result in income and expenditure being wrongly overstated.

7. Claim Gift Aid

Once all transactions relating to the financial year have been reconciled, it’s worth creating and then submitting any Gift Aid claims relating to the financial period. Fund accounting packages like ExpensePlus that integrate directly with HMRC, and have excellent inbuilt functionality for automatically generating and auto-accruing Gift Aid claims, make this easy to do.

Where donations are given for a specific purpose, and therefore allocated to a restricted fund, any Gift Aid claimed on these donations should also be allocated to the same restricted fund.

Creating Gift Aid claims will enable you to know how much income you need to accrue for in your year end accounts. So, having submitted Gift Aid claims, you should add an Accounts Receivable adjustment for any amounts relating to your financial year that weren’t received into your bank account before year end.

8. Accruals and Deferrals

Fund accounting packages like ExpensePlus offer an Auto-Accruals feature, which means your accounting software will automatically add accruals for you, largely removing the need to manually add accruals.

However, there is likely to be a small number of adjustments to add manually. It’s also worth reviewing all of the auto-accrued transactions that are still outstanding at year end.

Here are some common accruals and deferrals that you may need to account for:

Accounts Receivable (money owed to the charity)

- Gift Aid (where Gift Aid relating to the financial year has yet to be received at year end)

- Customer Invoices (where payment from the customer is outstanding at year end)

ExpensePlus has the functionality to auto-accrue Gift Aid claims, meaning there is no need to manually accrue for Gift Aid that is yet to be received at year end.

Where customer invoices are auto accrued, for any that are showing as ‘outstanding’ at year end, check these are correct and that payment is due in. Where there is little possibility of receiving payment, consider whether the customer invoice needs to be written off as a bad debt.

Accounts Payable (money the charity owes)

- Supplier Invoices (dated in, or related to the financial year but not paid until after year end)

- Expense Claims (expenses relating to the financial year but not paid until after year end)

- HMRC PAYE and Pension Contributions (payroll payments relating to the last month of your financial year but not paid until after year end)

- Independent Examiners Fee (relating to the examination of the financial year accounts)

Where supplier invoices / expense claims are auto accrued, for any that are showing as ‘outstanding’ at year end, check these are correct, and that payment is due out. Where any are duplicates or incorrect, ensure these are cancelled so that the amount owed correctly reflects the money that your charity owes.

Prepayments (money the charity paid out in advance)

- Insurance (for the proportion of the annual cost paid upfront that relates to a future financial year)

- Other goods and services paid for in advance (e.g. IT licences)

Deferred Income (money the charity receives in advance)

- Income such as rental income and wedding deposits that relate to a future financial year

9. Investment Gains / Losses (if applicable)

If your church or charity has investment accounts, you should check that any gains / losses have been recorded correctly. Check that your investment account balances at year end match the balances shown on your investment statements.

Your Independent Examiner will want to view statements for your investment accounts for the financial year in question. So, it’s worth saving a copy of these ready to send over.

10. Loans (if applicable)

If your church or charity has loans or mortgages, then you should check that the repayments have been correctly recorded. Where loan repayments include both a ‘capital repayment’ amount and an ‘interest’ amount, these must be recorded correctly. Check the account balances at year end match the balances shown on your loan / mortgage statements.

Your Independent Examiner will want to view any loan / mortgage statements for the financial year in question. So, it’s worth saving a copy of these, ready to send over to them.

11. Fixed Assets

Fixed Assets are long-term tangible pieces of property or equipment that a charity owns and uses in its operations. They include IT equipment, vehicles, land or buildings. Fixed assets form part of what a charity owns and they are included on a charity’s balance sheet.

As part of creating year end accounts, you first need to ensure that you have capitalised purchases during the financial year according to your charity’s capitalisation policy. The easiest way to check that this has been done correctly is to search all purchases made during the financial year, and check which have been caplitalised, and which have not been, and make updates to this where required.

Once done, it’s then important to check that the correct depreciation period has been set for each fixed asset (based on your charity’s fixed asset capitalisation and depreciation policy), and that depreciation has been correctly recorded for each asset for that financial year.

Where a charity owns land or buildings, this will need to be revalued periodically (e.g. every 3-5 years). Where applicable a revaluation will need to be recorded against the asset.

Fund accounting software like ExpensePlus has an inbuilt asset register which makes capitalising, tracking, and depreciating Fixed Assets easy to manage.

12. Category Transfers

If you have added category transfers, you need to check that these have been recorded correctly.

For example, you choose to set aside 10% of your general donation income to go towards a specific purpose or project e.g. to support other charities. You may wish to record this using a monthly income category transfer from your general fund to the appropriate designated fund.

Or perhaps your charity runs a foodbank that operates as a separate fund and it’s been agreed that they will pay £200 per month towards rent and utility costs. Then a monthly expenditure transfer would be a common way to account for this.

It’s important that category transfers are only ever between income and income categories or expenditure and expenditure categories. They should never be between expenditure and income categories. This would result in you wrongly overinflating your charity’s income and expenditure.

If you use ExpensePlus as your fund accounting package, then it’s not possible to make a transfer from an expenditure category into an income category. However, most accounting packages don’t prevent you from doing this. This means you need to check that this hasn’t happened, otherwise your accounts could be wrong.

In a similar way, if you would usually send invoices to groups for using your building, it is important to differentiate between those from your own legal entity or not. For example, if the group in question is part of your own legal entity (e.g. a foodbank), it’s important to account for any money paid from the foodbank fund to the general fund as an expenditure category transfer. Otherwise, you will also wrongly overinflate your overall charity’s income and expenditure.

13. Fund Transfers

If you have added any fund transfers, you need to check that these have been recorded correctly. You may also need to add fund transfers.

For example, many charities have a designated reserves fund. Your trustees might decide to set aside an additional amount of money from your general fund to increase the level of reserves your charity holds. This would require a fund transfer from your general fund to your reserves fund.

Fund transfers are typically never from a restricted fund into another fund. The only exception to this would be if a donor or grant funder has given written permission for their donation to become unrestricted and used as general funds. Instead, you should code relevant expenditure to the restricted fund.

If you are unsure, then you should ask your Independent Examiner, who should be able to advise you.

14. Gifts in Kind

Gifts in kind are gifts or donations that come in a variety of forms including goods, property, and services. Under the Generally Accepted Accounting Principles (GAAP), ‘gifts in kind’ should be reported within a charity’s financial accounts.

For example, if a charity can use a £10,000 per month premises rent-free, in their year end accounts the charity would show this gift in kind by including £120,000 of income. This would represent the donation that is being given over the 12 months. And they should record £120,000 of expenditure to represent the amount that the charity would have paid had the building not been rent-free.

If you have received any gifts in kind, these will need to be included in your accounts.

15. Check Closing Fund Balances

We’ve already mentioned in step 1 that fund balances carry over between financial years. Therefore, it’s really important to ensure that your closing fund balances are correct.

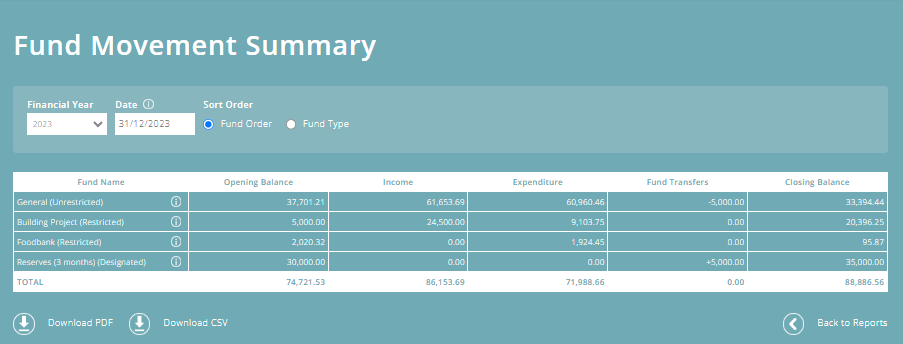

If you are using a fund accounting package, then the best way to do this is to use the Fund Movement Summary report, which will provide a brilliant summary of:

- The opening balance for each fund at the start of the financial year

- The total income for each fund during the financial year

- The total expenditure for each fund during the financial year

- Any fund transfers during the financial year

- The closing balance for each fund at the end of the financial year

This will give you a final opportunity to sense-check that you didn’t miss anything in step 6 when checking transactions were recorded correctly. It will also allow you to check the closing fund balances that will be carried forward into the next financial year.

For restricted funds, here are some things to watch out for:

- Where a restricted fund has little or no expenditure during the financial year – you might want to check that there isn’t any expenditure that could have been allocated to this fund that has instead been recorded to the general fund. Remember, you want to ‘use up’ your restricted funds first where this is within the restrictions of the money given.

- Where a restricted fund balance is running low – if you are continuing the project or activity this relates to, then you may wish to apply for more grants or ask for additional donations, or plan for expenditure to come from your general fund when the restricted fund is used up.

- Where the project relating to a restricted fund has ended – you might need to communicate with the grant funder or donors about this or think about how you can use the money in another way that is still within the restrictions for which it was given.

Remember, you need donors’ / grant funders’ written permission to either change the restrictions on the money given or to transfer money to be unrestricted for general use.

Typically, no funds should end the financial year with a negative balance. The exception to this is when you are awaiting income e.g. a grant that is about to come in. Where a fund has a negative balance, typically you will need to either:

- Re-code some of the expenditure currently allocated to the fund to a different fund (e.g. the general fund), to prevent the fund balance from being negative, OR

- Add a fund transfer (see step 7) to get the fund balance back to zero, e.g. transferring money from your general fund to the fund with the negative balance.

If you are unsure, then you should ask your Independent Examiner who should be able to advise you.

Using a template to create year end accounts

Once you have completed the checklist, creating year end accounts is quick and easy. You don’t need to be a trained accountant to prepare year end accounts. For many smaller charities, year end accounts are often prepared by a volunteer treasurer.

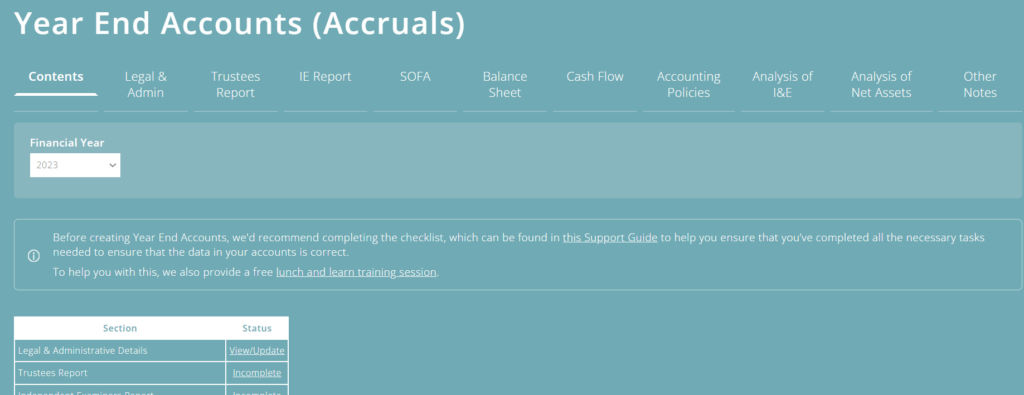

Creating your own accounts

If you use a fund accounting package like ExpensePlus, then you will find an accounts template is inbuilt. Since all of your accounting information will automatically populate into this template, you don’t need to spend time finding, copying and pasting data.

You will need these reports to complete your statutory accounts:

- the Statement of Financial Activities ( otherwise known as the SOFA report); and

- the Statement of Financial Position (otherwise known as the Balance Sheet); and

- the Statement of Cash Flows (which you only need to include in your statutory accounts if your income is above £500k in England and Wales).

In addition to financial information, there are several other disclosures that need to be included. Alongside the accounts template, there should be guidance and default text to help you.

Asking your Independent Examiner to create your accounts

For an additional fee, some Independent Examiners may also offer to prepare your accounts for you. However, if you want an easy way to create accounts, then it might be better to invest in software like ExpensePlus that will simplify the process and guide you through what you need to do.

Trustees’ Annual Report (TAR)

As part of the information in the accounts template, your accounts need to include a Trustees’ Annual Report. This is a written report that contains details of the objects of the charity and a summary of the charity’s main activities and achievements.

The Trustees’ Annual Report doesn’t need to be very long, typically 2 to 3 pages is sufficient. Rather than writing the report from scratch each year, many charities simply update 2 to 3 paragraphs in the report to reflect any changes, achievements or highlights that have happened in the financial year. Largely, the main activities of most charities won’t change year on year, nor will the objectives.

The Trustees’ report should be written with the audience in mind. Typically, it will only be seen by:

- Your charity’s members (as part of presenting the account at your AGM)

- Potential grant funders (who are likely to view your accounts on the Charity Commission website)

While your Trustees’ Annual Report is unlikely to be the main way you look to communicate the activities, achievements and needs of your charity to your wider audience of donors and supporters, it is public and may be viewed by anyone.

This blog on ‘What makes a good Trustees’ Annual Report’ gives some helpful advice about what to include and how to make it more engaging.

Once you’ve prepared your accounts and written your Trustees’ Annual Report, you are ready to move onto the final stage of submitting accounts.

If you are using fund accounting software, then it’s worth locking the financial year you have created accounts for to prevent any changes. This avoids the balances in your accounting software from no longer matching your submitted accounts.

Independent examination and submitting accounts

In this section, we will cover:

- Independent examination

- Signing of accounts, and

- Submitting accounts to the Charity Commission.

Independent examination

Having created your year end accounts, if your charity’s income is over £25k, you will need your accounts to be independently examined before they can be submitted to the Charity Commission.

There are no specific qualifications required to be an Independent Examiner of charity accounts where the charity’s income is below £250,000. However, the examiner must be independent and have the necessary skills and experience. They can’t be a trustee, an employee, a beneficiary, a major donor, or involved with the running of your charity or related to someone who is any of these things.

In terms of skills and experience, the Charity Commission recommends that examiners for charities with an income over £100,000 have a qualification in charity finance or be a qualified accountant.

However, it’s worth bearing in mind that just because someone is an accountant, that doesn’t mean they have any experience of charity accounting, or necessarily understand fund accounting.

This can be problematic with some Independent Examiners failing to spot basic fund accounting mistakes, and unable to correctly advise charities when fund accounting questions come up.

Other common problems that charities experience with Independent Examiners include:

- Overpaying for Independent Examination – this can be avoided by getting quotes from 2 to 3 different companies;

- Independent Examiners advising charities to use business accounting software – this often comes from a lack of knowledge of fund accounting. Many accountants want what is easiest for them, rather than what is best for the charity paying them;

- Inefficient Examination Process – some examiners require reports and receipts to be manually downloaded and sent to them, rather than simply providing access to the accounting software that contains the data.

You are free to switch Independent Examiners – you don’t need to stick with your existing examiner. We can highly recommend both Wyatt & Co and Stewardship. While we get no benefit from recommending these companies, we do so because both have excellent knowledge of fund accounting, they aim to help churches and charities and have reasonable fees for the service they deliver.

You should choose an Independent Examiner who has an excellent knowledge of fund accounting and who can support you with any questions. Their independent examination should provide your trustees with confidence and assurance that your charity accounts are correct.

Information needed by the Independent Examination

In terms of the information your Independent Examiner is likely to need, this will include:

- Your created accounts

- Access to the data from which the accounts were created, e.g. the transactions by account report from your fund accounting software (also known as your General Ledger), or the spreadsheet used to track your finances

- Access to view receipts and invoices for purchases

- Access to view invoices sent, and income documentation for grants, legacies, and large donations received

- Copies of your bank statements (typically it is easiest to download these as .PDF files)

In addition to the above list, your Independent Examiner may require additional information such as:

- Access to minutes from trustee meetings

- Visibility of Gift Aid claims, or

- Trustee ID checks

It may be worth asking your Independent Examiner to send you a checklist of what they need.

The independent examination is typically quick, since it’s not a full audit of your accounts. However, your Independent Examiner is likely to have other clients also wanting independent examinations at the same time. We recommend you communicate with your Independent Examiner when you are likely to be ready for your accounts to be examined, and check with them what the expected turnaround time will be.

As part of the examination, your Independent Examiner is likely to come back to you with a list of questions. This is a good sign that their examination is thorough. For example, they may spot that the trustees listed in your accounts don’t match with those listed on the Charity Commission. Or they might ask for clarity about a related party transaction. Or they could ask you about the internal financial controls your charity has in place.

Once your Independent Examiner is satisfied with your accounts you can then move on to signing your accounts.

Signing your accounts

Your final draft accounts need to be circulated to your charity trustees for them to review. This is important because your trustees have a collective responsibility for the finances and running of your charity.

For most charities, charity accounts are formally agreed upon as part of a trustee meeting (either online or in person). The decision that the trustees take to approve the accounts is then minuted in the meeting notes.

Once this happens, one of the trustees needs to sign the accounts on behalf of all the trustees. They need to sign both at the end of the trustees’ written report and also at the end of the Asset and Liability Statement.

If your Independent Examiner hasn’t already signed the accounts, they will also need to do this on the relevant page in the template or supply you with their report, which you can then attach to your accounts.

Signatures can be digital (unless your charity’s governing document requires otherwise). Once signed, your accounts are ready to be submitted to the Charity Commission.

Submitting Accounts

Submitting accounts to the Charity Commission is done via the Charity Commission portal. If you don’t already have access to the portal, you will need to establish who in your charity does have access, or contact the Charity Commission to request access.

Uploading your accounts document to the portal is straightforward. It’s worth noting that the Charity Commission takes the opportunity to ask for some other information on your charity as part of the submission process. E.g. the amount of the largest donation your charity received during the financial year, the largest gift your charity has given, how many volunteers it has, the number of paid employees, etc.

If you are using an accounting package like ExpensePlus, then it is easy to find the information needed. Otherwise, you might need to save your submission and return once you have answers to these questions.

If you are a charitable company, then don’t forget that you will also need to submit your accounts to Companies House (in addition to submitting them to the Charity Commission).

How ExpensePlus can help

Using a fund accounting package like ExpensePlus will enable your charity to manage finances more easily. It will also provide you with a simple and easy way to keep track of funds and many other useful and time-saving features such as online expense management, Gift Aid management and integration, donation reporting, and much more.

It has all of the reports you will need to create accounts on an accruals accounting basis.

Creating year end accounts with ExpensePlus couldn’t be simpler, with an inbuilt accounting template which we have developed with the help of Stewardship. You can also provide your Independent Examiner read-only access to your online account, making the examination process much simpler.

ExpensePlus is a cloud-based fund accounting software package designed for churches and charities. ExpensePlus makes managing fund accounts simple and straightforward. It’s used by hundreds of charities and churches across the UK and is rated 4.8 stars (out of 5) on Google with over 900 user reviews.