ExpensePlus is celebrating the launch of its updated Gift Aid module, which enables churches and charities to submit claims directly to HMRC.

For many UK charities, Gift Aid makes up a significant part of their charitable income. This income stream was worth £1.3bn to UK churches and charities last year according to the latest government data.

When asked about ExpensePlus receiving HMRC recognition, Sam Lewis, Head of Customer Support said:

“Gift Aid is such an important income stream for Churches and Charities and our software enables claims to be submitted to HMRC at the click of a button!”

“According to research published by the UK Government, Gift Aid is not claimed on one-third of donations that are eligible for it, costing charities an estimated £600m.”

“With ExpensePlus it’s easy to track donation trends, follow up with new donors, and chase up donors without declarations. This further helps maximise Gift Aid income for churches and charities. For churches using ChurchSuite, there is a ChurchSuite donations export.”

What is ExpensePlus?

ExpensePlus is a cloud-based fund accounting package that enables churches and charities to streamline their financial processes. It provides a simple and more efficient way to process expenses, create accounts, view reports, manage donations, and claim Gift Aid.

As well as saving time and money, ExpensePlus enables teams to work remotely and provides staff with accurate, up-to-date, drillable financial reports. It is fully customisable and comes with brilliant help and support.

ExpensePlus is used by hundreds of Churches and Charities, and is rated 4.8 stars (out of 5) on Google with over 450 user reviews!

Brilliant Gift Aid Software for Charities

ExpensePlus provides a simple and efficient process for managing (and maximising) income from Gift Aid and via the Gift Aid small donations scheme (GASDS).

Recording Donation Income

Allocating donation income correctly is super efficient with most donations being auto-matched in bulk as part of the bank reconciliation process in ExpensePlus.

Managing Gift Aid Eligibility

In ExpensePlus, it’s quick and easy to add and manage donor Gift Aid declarations.

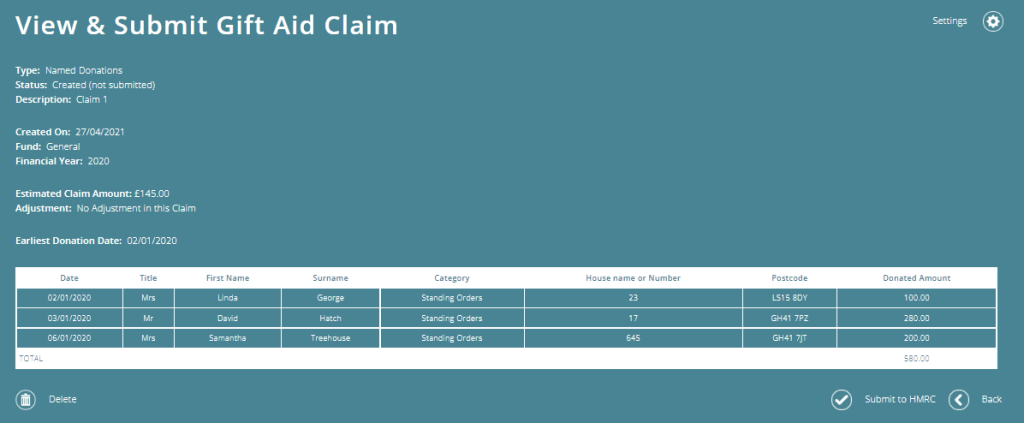

Creating Gift Aid Claims

ExpensePlus keeps track of which income transactions are eligible for Gift Aid and GASDS.

ExpensePlus automatically excludes donations where the donor doesn’t have a valid declaration covering the period of a donation. It also excludes donations that have been collected via a 3rd party processor such as Stewardship, CAF or Parish Giving Scheme where eligible Gift Aid will have already been claimed.

Donations are automatically prevented from being double-claimed and you can manually exclude donations from Gift Aid claims.

Submitting Claims to HMRC

With direct integration between ExpensePlus and HMRC, submitting claims couldn’t be simpler. Simply click the ‘submit to HMRC’ button. Typically around 7 to 10 days later HMRC will pay the money straight into your bank.

Allocating Payments from HMRC

ExpensePlus creates separate claims for each fund, making it easy to allocate payments from HMRC to the correct fund.

Maximising Gift Aid

As well as brilliant finance reports, ExpensePlus also has a suite of donation reports.

The ‘new donors’ report enables you to keep track of new givers so that you can thank them and ask them to complete a Gift Aid declaration.

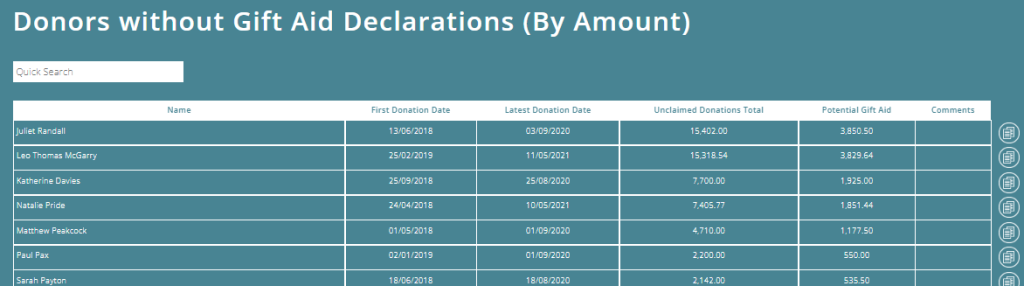

The ‘Donors without Gift Aid Declarations’ report enables you to see:

- which donors don’t have valid declarations

- how much they have given over the past 4 years

- how much potential Gift Aid you could reclaim if a donor completes a Gift Aid declaration and selects the option to backdate the start date.

This can help you prioritise and keep track of which donors still need to be followed up.

You can see that for churches and charities that use ExpensePlus, claiming both GASDS and Gift Aid couldn’t be simpler. ExpensePlus provides an efficient process for allocating donation income, tracking Gift Aid eligibility, and creating Gift Aid claims. You can find out more or sign up for a free trial on the ExpensePlus website.