In the world of church and charity finances, there is a growing trend of away from cash donations toward giving via cashless methods instead. For example, via a contactless card reader.

If your church is anything like mine, your established donors probably already give via standing order, or moved to that donation method during lockdown. However, in an increasingly cashless society, how can we encourage those who are not yet giving to start their giving journey?

A world without cash

This was the question I asked myself as we noticed our cash offering basket donations dwindling; How do we encourage new donors to give when they don’t carry cash anymore?

Since people typically don’t begin giving by setting up a standing order or Direct Debit, but rather through one-off donations, it is crucial to have a contactless card reader if we want to see future donor growth and not miss out on one-off donations.

In this blog post, I’ll explore and compare some of the popular options I looked at when researching which card donation device to select for my church. I will compare the hardware, features, and costs of four different devices so you can make an informed decision about which option is best for your church or charity.

What about using a simple contactless card reader?

Whilst you could just purchase a relatively cheap SumUp, Stripe or Square contactless card reader for as little as £20 to £30 and use this to accept card donations, this is unlikely to be the best option.

Whilst these simple devices enable you to take card payments, you won’t know which donor gave the money or what their donation was for. This creates multiple issues:

Purpose of donation: Firstly, without the ability to track whether the donation was given for a specific purpose or not, there is little way of knowing whether it is a restricted gift, and if so which fund to allocate it to. Furthermore if the card reader is also used for other purposes (e.g. sales of sweets, event tickets etc.) there won’t even be certainty as to whether the income relates to a donation or not.

No donor name: Secondly, you won’t have visibility as to which donor gave the donation. One of the great things about using an option from one of the providers covered in this blog is that you will not only have visibility of who has given and how much they have given, but if you use accounting software like ExpensePlus, this will all link up, and within your donation report and donor statements you will be able to see visibility of all donor donations regardless of whether these are via bank transfer, standing order, direct debit, card, cash or another donation method.

No Gift Aid: Thirdly, although you will ‘save money’ on upfront hardware costs and transaction fees using a simple card reader, you’re likely to be losing money overall. Providers like ColletTin, Payas, Dona and GiveStar offer the option for donors to Gift Aid as part of the donation process when giving via card, which will enable you to claim an additional 25% on top of the donation amount back from the government (which typically far outweighs any ‘saving’ of just purchasing a cheap card reader to accept donations.

Limited use: Finally, a SumUp, Stripe or Square card reader sitting on a table is unlikely to have the same impact as a touch screen donation kiosk. A kiosk solution can be switched on and left unattended, allowing donors to use it when they choose to do so. This is typically not the case with a card reader, which typically automatically goes into standby mode when not in use.

Whilst just purchasing a simple contactless card reader is cheaper than the options listed below, the amount of donations will be lower and you’ll be missing out on Gift Aid. Therefore, overall it’s unlikely to prove to be a good option for most churches and charities.

Understanding the options for contactless card readers

When searching for solutions to accept card donations, it’s important to understand that it will likely involve a combination of custom hardware, off-the-shelf hardware, and various third-party software and payment processors.

The Providers

There are many companies available, but for the purpose of this blog, I will limit myself to these four popular options:

| CollecTin – Their strap line is ‘Giving made simple’. They say “We designed CollecTin® to be as easy to use as possible, so you can concentrate on reaching your supporters, and we can take care of the technology that makes it all happen”. Offering a range of small to medium sized devices, they are one of the more cost-effective options. https://collectin.com/ |

| Payaz – “Increase charitable income through the use of technology” is the simple remit Payaz have given themselves. With a number of different hardware solutions available, from handheld to permanent installations, they are one of the more expensive options we’ll look at. https://www.payaz.com/ |

| Dona – Dona is a specialist technology consultancy based in London that partners with charitable organisations. They keep things simple, offering a single donation device, but their solution is currently the most expensive option on this list. https://donadonations.com/ |

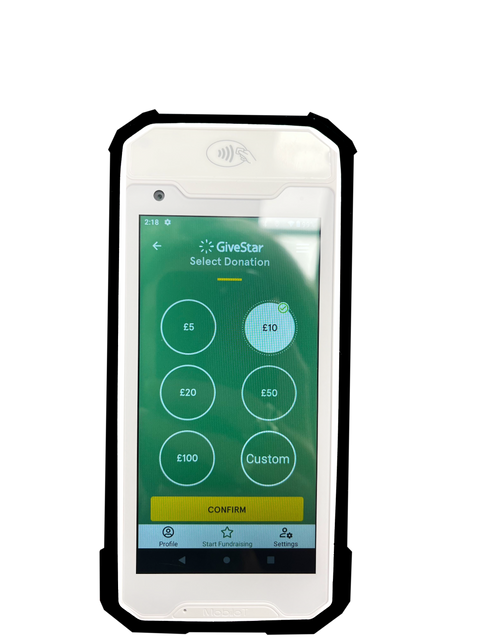

| GiveStar – Unlike other providers, GiveStar approaches the problem slightly differently by offering devices that are the size of a smartphone. This has a number of advantages, the biggest being they are the cheapest in the comparison table below. https://givestar.io/forcharities |

The Hardware

In most cases, a solution includes three hardware components bundled together. These three elements are:

- Touch screen – This part is usually some form of smartphone or tablet, normally an Android-based system.

- Card reader – This part collects the contactless payments and/or Chip and PIN donations. It is typically a small standalone device that is connected via Bluetooth to the tablet or smartphone.

- Casing – Below, we will see there are various options for housing the screen and card reader, ranging from permanent installations to movable and handheld solutions. Each option has its own set of pros and cons, which I’ll outline below.

The Software

The software may be custom-made by the provider or a third party, but it’s worth considering these two elements:

- The front end: used on the hardware for the donor to interact with at the point of giving and,

- The back end: used by your finance team to record income, track and manage giving, and claim Gift Aid.

Typically, you will need to pay for a subscription to access this software, although some offer a free “lite” version as we’ll see.

Device Comparison for contactless card readers

If you’re in a rush, here’s a summary of the contactless card readers with the main points of comparison for you. Keep on reading for additional details about each device, including a “Things to be aware of” section for each of them.

| CollecTin More by CollecTin | Give Station 3 by Payaz | Digital Collection Plate by Dona | The G3 by GiveStar | |

| Design |  |  |  |  |

| Hardware Cost | £320 | £429 | £495 | £186 |

| Software by | GiveALittle | GiveALittle | Dona | GiveStar |

| Contract | Yes, if using data | Yes, if using data | No fixed contract | No fixed contract |

| Monthly Cost | Free or from £7.50 + VAT | Free or from £7.50 + VAT | £12.50 + VAT | £3.50 per active user |

| Card Fees | 1.44% – 1.69% | 1.44% – 1.69% | 1.69% | 3.8% + 20p |

| Payment Processor | Stripe or SumUp | Stripe or SumUp | SumUp | Unknown |

| Internet Connection | WiFi or Data* | WiFi or Data | WiFi or Data | Data |

| Gift Aid | Yes | Yes | Yes | Yes |

| Lockable | Yes via Kensington lock | Yes | Yes via Kensington lock | No |

| Pros | Self-standing or handheld. Can be left unattended. Simple to operate. Contactless & Chip and Pin. Good value for money. | Very well mounted. Can be left unattended. Simple to operate. Contactless & Chip and Pin. | Various mounting options. Permanent or portable. Can be left unattended Contactless & Chip and Pin. No contract. | Very portable Cheap setup costs. |

| Cons | Lightweight so can get knocked over. The software is occasionally glitchy. Gift Aid is complicated if wanting to claim GASDS. | Size and weight make it less portable than others Gift Aid complicated if wanting to claim GASDS. | Awkward design. The most expensive option. Limited card processor options. Longer sales process. | Looks like a smartphone. No WiFi connection. Can’t be left unattended. Expensive card fees. Longer sales process. |

*Requires a multi-network card from Daisy Communications and 500MB per month costs £42 + VAT for 12 months

After conducting my research, we decided to use CollecTin More for our church. It has been a really good experience using it for the last 6 months and it’s paid for itself several times over already. As a result, I have a good working knowledge of the device and the GiveALittle software. However, I have not used the other hardware and software options in this table, so I have relied on secondary sources of research for the comparison.

The CollecTin More – by CollecTin

The CollecTin More is the flagship device from this company. It consists of an Android tablet and SumUp card reader housed inside a solid plastic casing that can be freestanding or handheld. The lid flips up to reveal the SumUp Chip and PIN reader. The product includes a rechargeable battery that is located inside the hand grip. It keeps the tablet and card reader internal batteries charged, if the optional mains power adaptor is not being used.

Hardware Cost: £320 with optional extras like lockable mounts, power cables etc.

Subscription Cost: The donation software is provided by GiveALittle, who offer a free “lite” option. However, to access Gift Aid and customisable campaigns, a tiered subscription model starting at £7.50 + VAT for donation levels up to £7,500 per year is required. The first 3 months are currently free – https://givealittle.co/pricing.

Data Cost: If using the data rather than WiFi, you’ll need to activate the built-in multi-network card from Daisy Communications. 500MB per month costs £42 + VAT for a 12-month contract. I’ve found the data card to work really well, even in places where other mobile phones don’t have data.

Card Processing Fees: If you’re using SumUp you’ll pay 1.69% https://sumup.co.uk/credit-card-processing-pricing/ or alternatively Stripe at 1.44% (with charity rate applied) https://stripe.com/pricing.

Things to be aware of:

- Apart from the occasional Android glitch, GiveALittle works fine on the front end of this device. There are however a couple of frustrating areas to be aware of:

- Gift Aid is best claimed via their software but the software does not integrate with HMRC directly. You have to manually download a report and claim via the HMRC website.

- Additionally, bank reconciliation can be complicated if you use your SumUp account for other card payments because GiveALittle does not correctly populate the description field within SumUp – see this ExpensePlus support article here for more detail.

- The device is really designed to be handheld, and positioned so that the person donating can see the screen. If used as a stand-alone device, the screen is not at the optimal angle for easy use, and people normally pick it up to input their details. this works fine, but it’s something to be aware of.

Who might this be best for?: Churches that don’t have their own building and need to pack their device away each week. Also for charities holding fundraising events in multiple locations. In all cases, organisations that use SumUp exclusively for donations via GiveALittle.

Giving Station 3 – by Payaz

This is the Rolls Royce of the donation devices! It’s an attractive setup, with a robust case holding a large 10″ screen with a fully lockable steel enclosure, finished with birch plywood edges. At 6kg, this is a heavy option designed to be installed in one location and not moved.

Hardware Cost: £429

Subscription Cost: The donation software is provided by GiveALittle with their tiered subscription model starting from £7.50 + VAT https://givealittle.co/pricing.

Data Cost: Payaz supply the unit with an M2M priority data SIM card, but there are no details of the costs associated with this. You can use your own SIM card instead if you wish.

Card Processing Fees: If you’re using SumUp you’ll pay 1.69% https://sumup.co.uk/credit-card-processing-pricing/ or alternatively Stripe at 1.44% (with charity rate applied) https://stripe.com/pricing.

Things to be aware of: Like the CollecTin More, the Giving Station 3 runs on GiveALittle – please see the CollecTin More section if you’ve not yet read about the limitations of this software.

Who might this be best for?: Churches with their own buildings who are willing to pay to get a smart and permanent installation and who don’t need the flexibility that a handheld device offers.

Digital Collection Plate – by Dona

Dona have only one device on offer with a quirky (awkward?) design that you’ll either love or hate. The device combines a tablet with an integrated SumUp card reader attached securely to the bottom right corner. Dona provide a range of mounting options, allowing you to use it as a passable collection plate, or fix it within a permanent housing to one of their floor-mounted or bespoke order stands.

Hardware Cost: £495 – the priciest hardware option on this list.

Subscription Cost: Dona’s software has a flat pricing structure of £12.50 + VAT per month.

Card Processing Fees: 1.69% via SumUp only, there are no other processor options.

Data Cost: The Digital Collection Plate will need a data SIM card to work. It’s not clear if this is supplied with the device so check if you arrange a call with them (see the CollecTin More for an idea of costs associated with multi-network SIM cards)

Things to be aware of: Dona’s sales model requires you to arrange a phone call with them if you want more than the limited information on their website. As such, it’s hard to know how the software really works, and adds an extra hurdle to the ordering process.

Who might this be best for?: Churches that are happy to use SumUp only and are looking for multiple options to mount their device, including the option to order bespoke stands and casings.

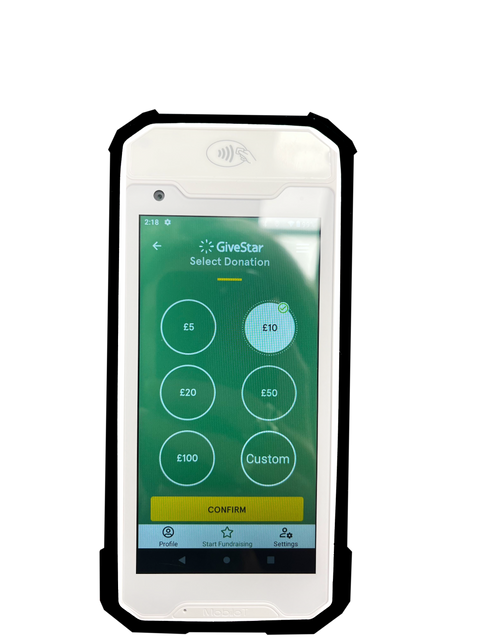

The G3 – by GiveStar

GiveStar approach cashless donations from a different angle, using smaller smartphone sized hardware to accept contactless payments.

Hardware Cost: £155 + VAT gets you what looks to be an Android smartphone running GiveStar’s donation software.

Subscription Cost: There’s no monthly subscription fee, instead a £3.50 “active app” fee is charged per user, per month (but only once they have raised over £10 in the months they are active).

Card Processing Fees:

- 1.9% + 20p card processing fee (note: 2.9% + 20p card processing fee with international & AMEX cards)

- 1.9% GiveStar fee (with an option for the donor to cover this)

Data Cost: The G3 will need a data SIM card to work (not supplied as far as I can tell) – see the CollecTin More for an idea of costs associated with multi-network SIM cards.

Things to be aware of:

- The very small screen compared to the other options here may make it more difficult to use for some donors. Being a handheld device, it will require to be manned by a volunteer to ensure its security and correct use. Remember there’s no Chip and PIN option either. That could be a problem for when contactless is refused and requires a PIN instead, or the donor wants to give more than £100.

- GiveStar’s sales model requires you to arrange a video call with them before they give you access to their sales website where you can then start the order process.

- GiveStar also offer a “Tap on phone” option. This is the same package as above, except you use your own mobile phone, saving on the hardware costs. However, currently this is only available on Android Phones with operating software 8.1 or higher at factory level, and the phone needs to have an NFC reader.

Who might this be best for? This is for churches on a budget for hardware but don’t mind higher card fees. They prefer to have manned giving stations and do not expect large donations that would require Chip and PIN functionality.

Pricing for all contactless card readers is correct at the time of research.

Pete Marfleet is a verified ExpensePlus consultant and bookkeeper. He offers a range of cost-effective services, from outsourced bookkeeping and ExpensePlus training, to project managing the migration of your current accounting systems to ExpensePlus.