Does your church or charity currently have a budget? Are you using it effectively? In this blog, you can learn about top tips for budgeting. We’ll look at creating your church or charity budget and how to manage your budget throughout the year.

Why create a budget?

This is important to consider upfront. Unless you’re clear on the purpose and benefits of budgeting, you may spend lots of time creating a budget, but not experience the practical benefits.

Here are some reasons to create a budget:

- To plan how you will spend money

- To help establish priorities and spend money on the ‘right’ things

- To support effective decision making

- To empower ministry or project leaders by assigning them financial resources to use

- To provide a benchmark for measuring finances

- To mitigate risk and prevent overspending

- To build trust with donors that money is being managed well

- To enable accountability and good practice

- To enable your church or charity to achieve its vision

- To support other essential financial management procedures such as annual reporting

A budget is a simple yet powerful tool which can help you make important financial decisions for your church or charity.

Money is one of the key resources a church or charity has to fulfil its mission, vision and goals. Yet too often we fail to ask the question ‘What if we align all our resources (staffing, activities, communications, finances) around our mission, vision and goals?

The challenge is that most churches and charities already do many ‘good things’. Prioritising means making some tough decisions. Possibly it means stopping some good things to make space for the things that are important to achieving your church or charity’s vision. This is where effective budgeting can help.

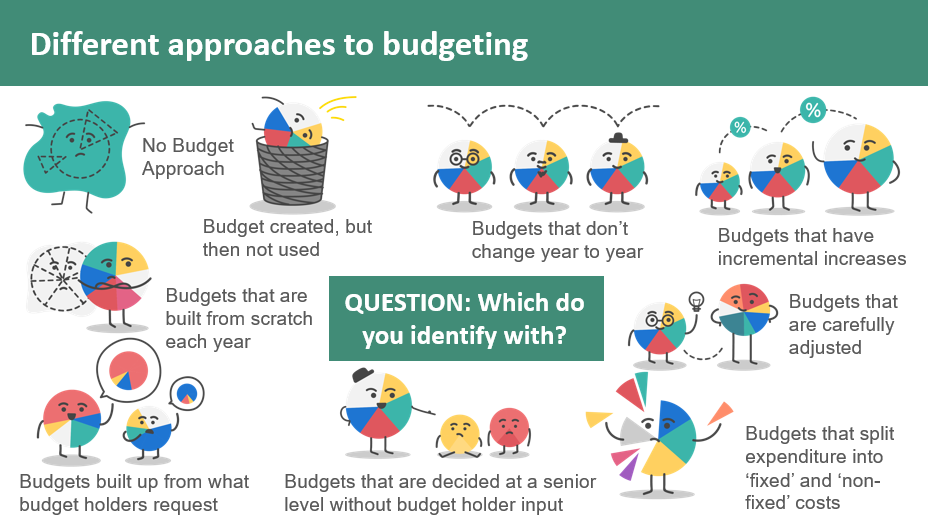

Approaches to Budgeting

When it comes to budgeting there are many different approaches. Which of these do you most identify with?

As a team, you may want to consider how you each approach budgeting. You could also discuss the benefits and drawbacks of the approaches you have previously taken in your organisation.

Which budgeting approach is the best?

That is a great question! Some of the above approaches are quicker, some are slower. There are simple and more complex approaches. Some are proactive, some more reactive. Each has advantages and disadvantages.

This video by Tim Wyatt, from Wyatt & Co Chartered Accountants, explains some of the approaches you could take:

- detailed versus high-level budgeting

- using what you know from previous year’s income and expenditure

- knowing and communicating your budgeting principle – prudent, realistic or aspirational

- understanding how your budget is different from your financial forecast

Steps for creating an effective charity budget

Step #1: Review if your current expenditure aligns with your vision

If you do what you’ve always done, you’ll get what you’ve always got.

As Tim explained in the video, it’s helpful to look back and build a picture of your current income and expenditure.

Creating next year’s budget from the current year’s income and expenditure would seem like a sensible approach. It’s fairly simple, and it takes into account changes to income and expenditure that have happened this year. It means that the budget for next year could be fairly realistic.

However, this doesn’t challenge the assumption that what happened this year was good. What if it didn’t help you meet your vision and goals?

Aligning your budget with your vision will enable you to maximise the impact of your financial resources. It will put you in a better position to achieve your vision and goals.

Before beginning the budgeting process, ask yourself:

- Is each project contributing to achieving our overall vision and goals?

- Do we have sufficient income to run a project?

- Are there areas where you need to increase or decrease your spending to reflect our priorities?

- Are there better or more effective ways to achieve the same goals?

And then check again and use the answers to these questions to adjust your budget.

Step #2: Be Realistic

Creating a budget that ‘adds up’ but is not realistic is arguably no better than not budgeting at all. You should also consider your financial position when starting the budgeting discussions.

You’ll always have more things you want to do – budgeting is about prioritising. And having limited resources encourages effective resource usage.

There will often be unexpected costs or new things that come up. To counter this, ensure your budget includes a contingency (either within each budget line or as a bulk line item).

Take care when decreasing budget lines – work out the specifics of how you will achieve a decrease. Otherwise, you are planning to fail.

In the video, Tim explained that you should choose, know and communicate your underlying budgeting principle. Is your budget based on your being prudent, realistic or aspirational?

If you are a church, faith will also play a role as you create your budget. Some churches entirely exclude any element of faith from budget discussions. Other churches think that budgeting isn’t needed, possibly on the assumption that ‘God always provides’ or that having a budget prevents them being ‘led by the Spirit’. There is clearly a balance to be had. A budget is a useful tool. It’s helpful as you look to fulfil your charitable obligations and have the necessary financial controls and appropriate plans in place to be good stewards of God’s financial provision for the church. And as you budget, you can pray together as a team for faith, discernment and wisdom.

Step #3: Use the budgeting process to empower your team

You need your team to engage with and ‘own’ the budget that you create. Otherwise, you are unlikely to get much benefit from having a budget. Help your team understand how the budget fits into the bigger picture of achieving the church or charity’s vision and goals.

Therefore, involving key leaders in the budgeting process is a good idea. It is often the best way to get ‘buy-in’. But you’ll also want to consider who in your church or charity has skills or experience that could help you as you think about budget planning.

How many people should you involve in the budgeting process? It will depend on the size of your church or charity but 4 to 6 people is typically ideal. It’s also a good idea to ask your budget holders to input their ideas and suggestions, or to submit proposals. When doing this, you’ll want to remind budget holders that their work is part of achieving the whole organisation’s vision and goals.

For example, there is little benefit in the budget holder who manages your building coming up with proposals that cost additional money, if you already know your church is needing to save 20-30% on expenditure in next year’s budget.

Similarly, if you know you want to invest more in youth work, then it’s worth asking your youth budget holder to come up with ideas. They are probably the best person to suggest how an additional £500 could be used to help achieve your vision and goals.

Practical steps for creating your budget

Now that you’re clear on your priorities, you’ve reviewed previous income and expenditure and you’ve spoken to your team, you’re ready to create a draft budget!

You can do this in a spreadsheet, or some finance software programmes (such as ExpensePlus) have a built-in budgeting tool.

Once you have created a draft budget, typically the second stage of the budgeting process has three parts:

- Make adjustments in order to ensure the budget created is both realistic and achievable

- Check that it aligns with your priorities as a church or charity

- Check it is ‘balanced’. This means the budgeted expenditure matches the budgeted income. Or, agree that you are happy for your overall level of cash reserves to increase/decrease according to the budget you have set.

Managing your charity’s budget well

Remember, a budget is just a document. Unless you actually use it when making financial decisions, it is likely to add little or no benefit.

Here are some top tips to help your team use the budget you’ve created.

Tip #1: Provide decision-makers with accurate, up-to-date finance reports

To make good decisions, it’s best when all budget holders and decision makers can see the relevant finance reports in real time at the right level of detail.

Most churches and charities don’t produce finance reports for the team until after month end. This creates a time lag between 2 to 6 weeks from when purchases happen to when they appear in reports. Also, most reports are paper-based or on PDF, so not ‘drillable’ nor customisable. People either see everything, or nothing!

An online fund accounting package like ExpensePlus will enable you to provide budget holders and key decision makers with up-to-date, accurate and drillable financial reports they can access anytime.

Tip #2: Empower those approving expenditure to make informed decisions based on the budget

It sounds obvious, but unless you make financial decisions based on the budget that has been set, creating a budget will have little benefit.

The approval process for expenditure within a church or charity should:

- Empower budget holders to have ownership

- Focus on the budget spent to date when approving purchases

Again, a good fund accounting process and a software package like ExpensePlus enables you to provide those approving purchases with the access and information they need to ensure that expenditure stays within budget.

Tip #3: Implement an effective process for reviewing finances

To spot problems early and make changes you need to be able to:

- spot where you have underspent or overspent easily, and

- project and plan forward.

Visibility of financial reports promotes accountability. A cloud-based fund accounting package like ExpensePlus offers customisable online financial reports that will help you do this.

Tip #4: Understand your key reports and structure your accounts in a helpful way

When structuring your income and expenditure categories (e.g. department or nominal codes), do so in a way that is going to help you produce simple reports. They shouldn’t be overly complicated and they should have the right level of detail for your organisation.

This will help you create useful and relevant financial reports that your whole team can use.

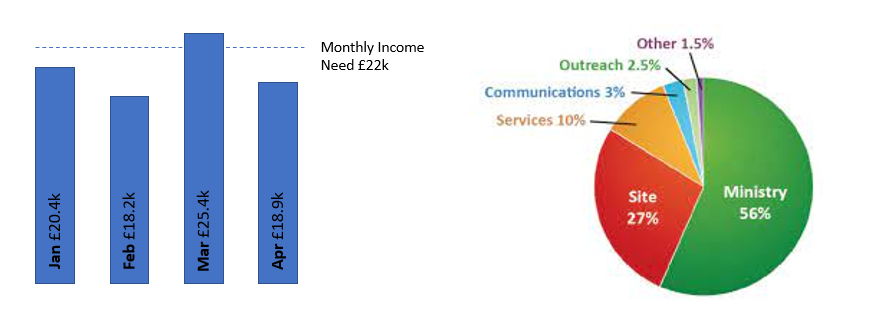

Tip #5: Encourage donations through how you communicate your finances

Many donors want to know how the money they give is used. They also want to understand the current needs of the church or charity. To engage your donors, we recommend you communicate finances in a timely way, and at an appropriate level of detail and frequency.

Sharing stories as well as numbers can help to show the impact of your church or charity activities. Here are some examples:

So, there you have it. Some top tips including why you should create a budget and steps on how to create an effective budget. Give it a go and see how it transforms your church or charity.

ExpensePlus is a cloud-based fund accounting software package designed for churches and charities. ExpensePlus makes managing fund accounts simple and straightforward. It’s used by hundreds of charities and churches across the UK and is rated 4.8 stars (out of 5) on Google with over 900 user reviews.