Fund accounting is a type of accounting used by charities. Charities must follow the principles of fund accounting when creating financial accounts. The focus of fund accounting is on accountability.

Creating accounts using fund accounting principles makes it possible to ensure that money is spent on (or earmarked for) the specific purpose for which it was given.

The principles of fund accounting apply to all UK charities. This is true regardless of whether your charity prepares accounts on a receipts and payments basis or an accruals basis.

Fund accounting is different from business accounting. Accounting packages that are designed for businesses (such as QuickBooks, Sage and Xero) don’t have the tracking functionality and reporting charities need for creating fund accounts. They also aren’t designed for managing donations and Gift Aid.

In the video below, Tim Wyatt, an independent examiner at Wyatt & Co Chartered Accountants explains more.

What is a Fund?

A fund is a pot of money or assets that is set aside for a specific purpose.

When you receive income, you must allocate it to a fund based on the purpose for which it was given.

Similarly, you must also allocate expenditure to a fund. This makes it possible to track how much money given for a specific purpose remains in a fund at any point in time.

Types of Fund

A charity can have just one fund or many funds. Each fund has a fund type. There are several types of funds which fall under one of two headings: ‘Unrestricted’ and ‘Restricted’.

Unrestricted Funds

| Fund Type | Key Word | Definition | Example |

|---|---|---|---|

| General | “Anything” within the charitable objects | Income that can be spent on anything within the charity objectives and activities. | General donations that have been given to the charity for its general work. |

| Designated | “Earmarked” by trustees or management | Designated funds are still unrestricted, but have been set aside by the trustees; ‘earmarked’ for a particular purpose, future project, or commitment. | Money set aside for purchasing new sound equipment, for future building development, or as financial reserves. |

| Revaluation Reserve | “Mirrors” the assets which have been revalued | A very specific fund which mirrors the value of assets held on the balance sheet which have been revalued. | Used when a building or investment property is revalued. |

Restricted Funds

| Fund Type | Key Word | Definition | Example |

|---|---|---|---|

| Income | “Legally” restricted by the donor | Restricted funds are held for a specific charitable purpose. Restricted funds can only be lawfully spent on the specific charitable purpose for which they were provided. | Donations intended for a specific fundraising project or a grant for a specific purpose. |

| Endowment | “Investment” specifically held to generate income for the charity | Funds that under trust law require charities to invest the assets or keep the assets to further benefit the charity. | A donated investment portfolio which can only be used to generate income from it. |

To find out more about the rules for endowment funds, take a look at this guidance from the charities commission and speak to your independent examiner.

Creating Accounts

Most churches and charities will have multiple funds, which can make creating accounts complex. The trustees of a charity have a legal responsibility to ensure that the different types of funds given for different purposes are managed in the correct way. This is why it is important for churches and charities to understand the principles of fund accounting.

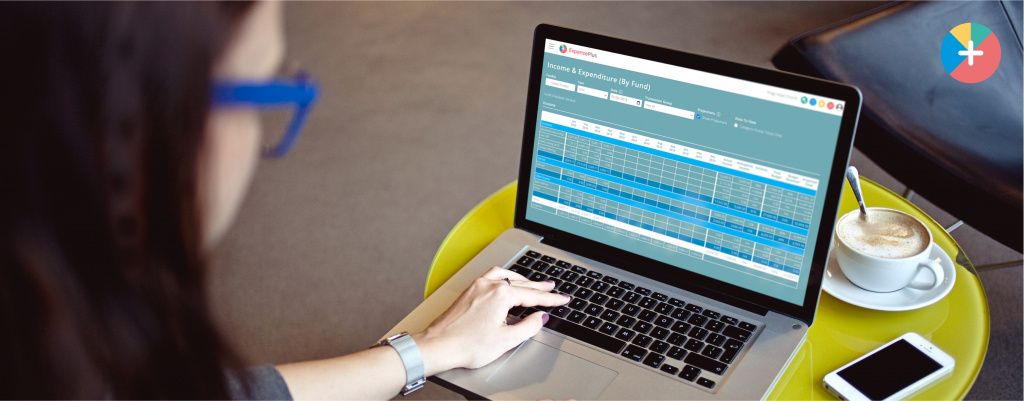

ExpensePlus is a cloud-based fund accounting software package designed for churches and charities that makes managing fund accounts simple and straightforward.

To find out more about Fund Accounting, click here to visit the Stewardship Resources Hub which has lots of helpful information and resources.

Tim is a qualified ICAEW Accountant at Wyatt & Co Accountants based in Leeds, which specialises in providing accounting services for charities, including independent examinations, outsourced finance, as well as governance advice.