All UK churches and charities must follow the principles of fund accounting when creating financial accounts.

In this blog, Tim Wyatt, from Wyatt & Co Chartered Accountants, shares his top tips for fund accounting. Tim has many years of experience working with churches and charities across the UK.

Tip #1 – Get into a routine with your finances

Having a routine with a checklist can really help you keep on top of your finances. You might have a monthly or quarterly routine, or both. The focus of fund accounting is accountability, so keeping your accounts up-to-date is really important. When you are creating accounts for your church or charity, a good routine is important. It will give you confidence as to:

- the tasks you need to do

- when they need to be done

- who will do them

This is particularly true when working as a team. Having a clear routine means that you can know who’s doing what and when and that everything is looking okay.

Perhaps start by mapping out the different tasks. Then decide who will do each task, and how often.

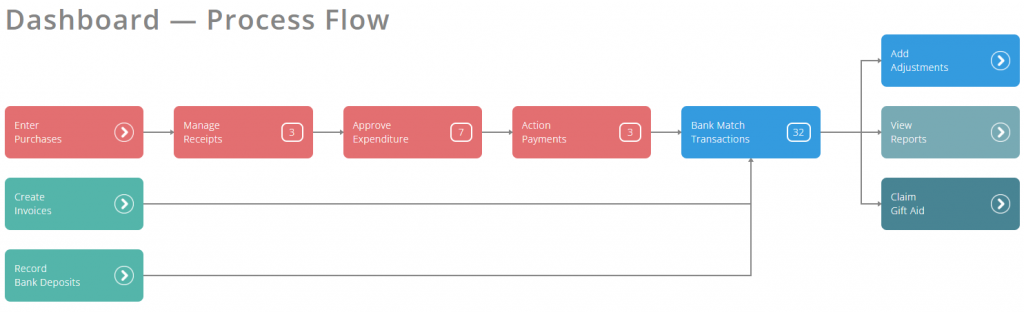

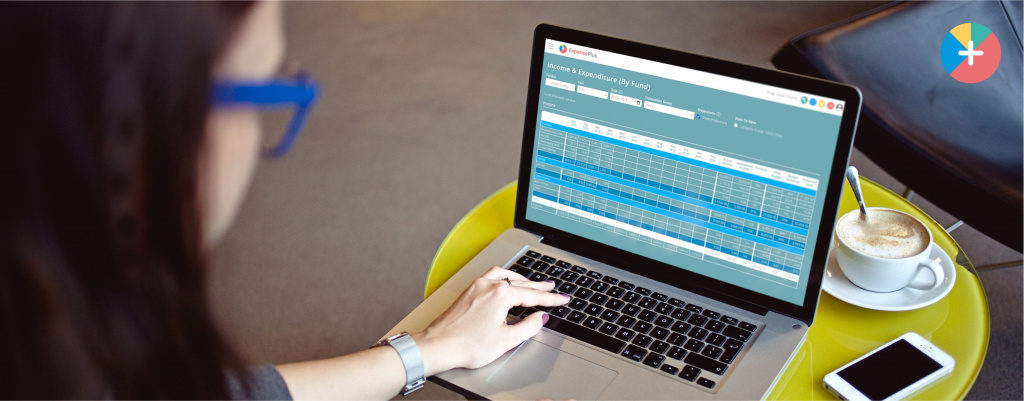

For churches and charities that use ExpensePlus, the process flow dashboard within ExpensePlus maps this out for you. ExpensePlus removes the need for time-consuming manual processes such as paper expense forms and keying in data to create accounts. ExpensePlus provides an efficient, streamlined financial process flow with far fewer steps.

Tip #2- Keep things simple

Unfortunately we, as humans, have a habit of over-complicating things. However, the best system is often the simplest one. This is true for fund accounting too!

Keeping things simple means you’re not going to have unexpected errors or problems.

“If your church or charity has a well-documented and simple system that gets you from A to B, you’re half way there to winning the battle of effective financial management.”

Tip #3 – Just Ask

Independent examiners and accountants are there to support their clients with their accounts. When churches and charities wait until after they prepare accounts to ask questions, this wastes a lot of time. Most problems can be removed just by asking for advice upfront.

Speaking to your independent examiner during the year is often helpful. It may well prevent both you and them from having to do extra work to fix problems at year-end.

You can also ask finance managers in other churches and charities about how they do things. For churches and charities that use ExpensePlus, one such feature is the user forum on Facebook which is a great place to get advice.

ExpensePlus is a cloud-based fund accounting software package designed for churches and charities. ExpensePlus makes managing fund accounts simple and straightforward.

To find out more about Fund Accounting, visit the Stewardship Resources Hub which has lots of helpful information and resources.